One year since the bottom

Did my headline work? Are you reading because a few simple words elicited an emotional response that you didn’t even realize was happening? Well get ready, because this week will be a media frenzy with somber music being played over montages of photos of the past year flashing across the screen. What have we learned in the past 12 months?

Timeless lessons of 2020

Risk is everywhere, even when we don’t sense it. Things can be “easy like Sunday morning”, until all of a sudden, they aren’t. This is an important lesson, and one that many who lived through 2008/2009 with their portfolios invested rarely forget, but for new investors this will be a lesson they always remember.

Getting to the other side

2020 and horror movies have taught us one thing, its all about survival. Getting to the other side as unscathed as possible and living to fight another day were paramount to your success in 2020. If preaching staying the course has ever paid off, 2020 was the year because staying the course has let you reap the rewards of the inevitable market recovery. You can only stay the course, if you have one to stay on. If you don’t have a plan or a path to keep you true to achieving financial freedom, that should be your 2021 goal!

Silly season has begun

Imagine a scenario where unemployment is dropping, the global risk of the pandemic is dropping, and economic activity is picking up drastically……. So, the stock market loses 10% and decides to become hyper volatile! Good news turns the market down, and bad news brings back the green we all love to see on our stock tickers.

This isn’t far off from reality, and is why I call this silly season. Good news should mean good things for the economy, and it does, but it also means rising interest rates. Cheap money becomes a bit of a drug as you are exposed to it for longer and longer. The prospect of rising rates will cause good news to turn markets negative. The prospect of losing that main line of free money sends shudders down the spine of stimulus addicted traders and CEOs alike.

Some good news

Rising rates will cause short term volatility, but the underlying cause being better than expected economic activity means long term prosperity. Just like we stayed the course in 2020, stick to your path forward and you will get to the other side of any short-term blips faster than you think. Let’s end today with some good news via charts, because I love a good chart!

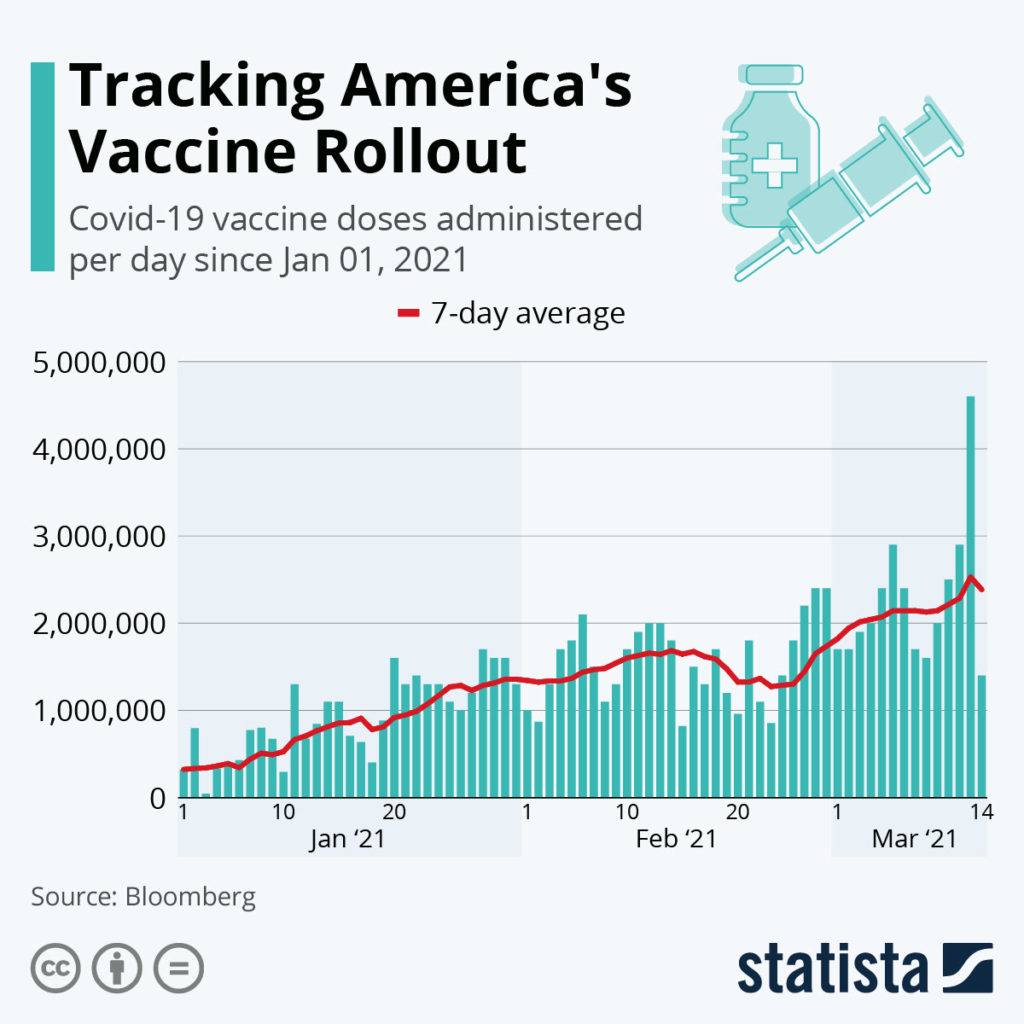

We are averaging nearly 2Mil vaccinations a day in the USA. Well on our way to protecting everyone who wants the vaccination.

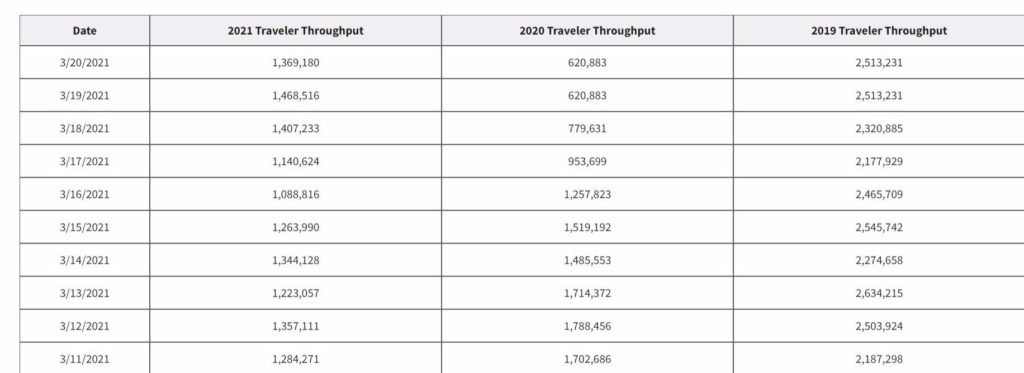

TSA data showing number of people crossing through TSA checkpoints at airports. Not at Precovid levels, but a nearly 100% increase from this time last year.

So What?

So how does this impact all of you?

- Risk is always present, just because you can’t sense it, don’t lose sight of it.

- There is good news, which will cause short term volatility but long term prosperity.

- Stay the course, and make sure you have a course to stay on. Make a plan.

Stock market calendar this week:

Thursday March 245th:

Initial and continuing Jobless Claims @ 8:30AM

Most anticipated earnings for this week