More “stimmy” on the way

Folks, before I begin, I just want everyone to know that “stimmy” is a real word that is being used to refer to people’s stimulus checks. I will use it in a sentence that I overheard this weekend at Wegmans Grocery Store.

“I wonder when the stimmy will hit my account, I already know how I’m going to spend it”

I don’t even have words to address how this makes me feel. I immediately called my mother and simply told her “I finally understand.”

More than a pretty face

On the surface what will get the most attention from the American Rescue Plan Act (ARPA) will be the direct payments being made to Americans, so let’s give a quick run down of what that looks like first.

- Provides another round of direct payments of $1,400 for individuals, $2,800 for joint filers, and $1,400 for each qualifying dependent.

- Dependents would include full-time students younger than 24 and adult dependents.

- The payments would begin to phase out for individuals with an adjusted gross income (AGI) of $75,000 ($150,000 for couples) and would be zero for AGIs of $80,000 ($160,000 for couples) or more. Heads of households will receive the full amount if they earned up to $112,500, and it will phase out completely at $120,000.

- Payments would be based on 2019 or 2020 tax returns. The Treasury Department could provide payments to individuals who have not filed based on return information available to the department.

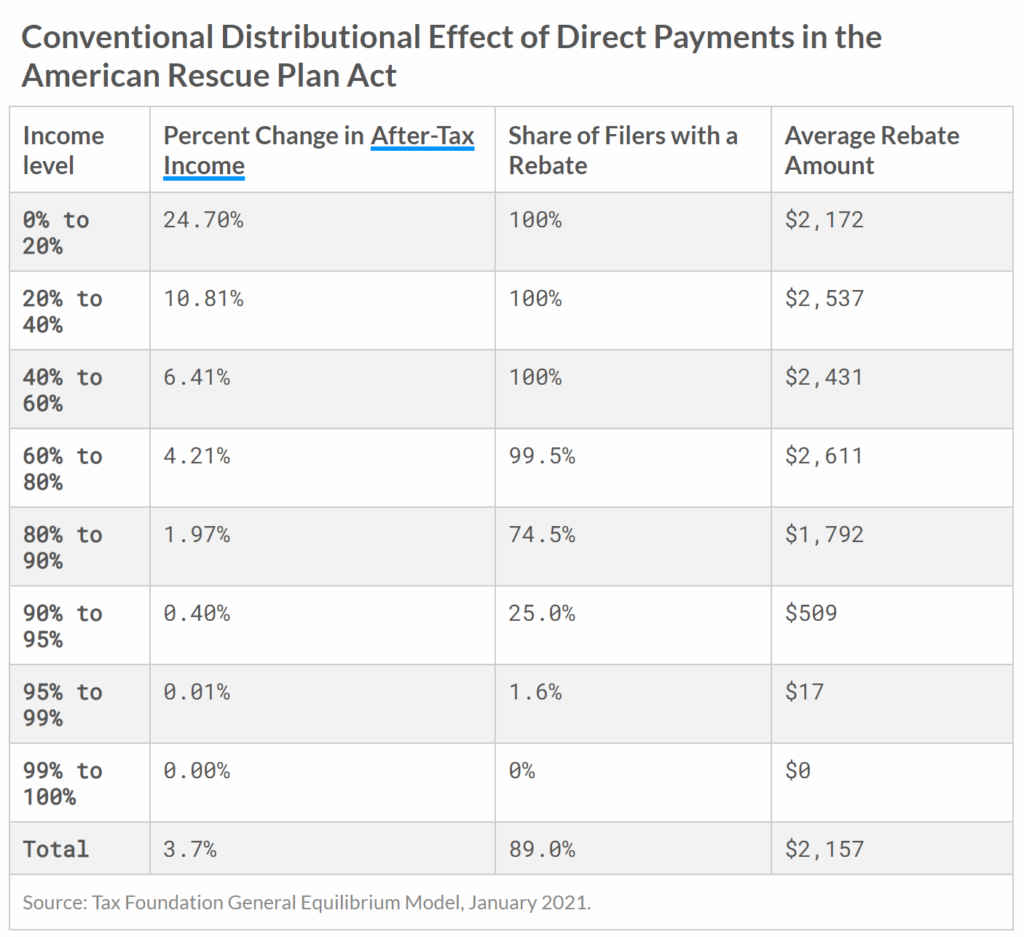

Here is a breakdown of the distributional effect if those payments in ARPA.

Out of control government spending is never good, but also nothing new. If the federal government is going to spend money, giving it directly to the American people would be my preferred use instead of corporate bail outs. Regardless of what the media tells you, the above chart is proof that ARPA is providing direct payments to those who need it the most.

Will some of you receive the stimulus payment and not need it? Yes, and that is a waste of government spending, but when trying to provide financial assistance to 99% of the population, segregating by income amount is the fastest and easiest way to target your desired recipients.

More than meets the eye

The American Rescue Plan Act isn’t just direct payments to Americans, and undoubtably depending on which TV station you watch they will tell you about how all of the money is being sent overseas or to fund abortion, while the other station will tell you that unchecked spending is no big deal, and that everything will be okay. Turn that noise off, and let’s look at real facts.

- $25.5 billion would be equally divided to provide each state a minimum of $500 million.

-

- State and local governments cannot use the funds towards pensions.

- Read this again before the media tells us how this is bailing out blue states. This Act gives each stats 500Mil, both red and blue states.

- State and local governments cannot use the funds towards pensions.

- $19.5 billion for towns with fewer than 50,000 people.

- Many of you reading live in a town of fewer than 50K people, I do. They will never lower taxes, but tapping federal funds to keep my taxes stable for a few years is helpful. Something I have already written to my towns mayor about, as I am sure many towns will try to tap these funds.

- $25 billion for restaurants, bars, and other eligible providers of food and drink.

- Creates a $7.2 billion Emergency Connectivity Fund to reimburse schools and libraries for internet access and connected devices.

- Through various charities that I follow and am active with I have learned what a vital role library played in low-income areas in helping children meet the resource requirements remote learning requires.

The real risk

What no talking head on TV will talk about, or financial advisor will touch with a 10-foot pole is one important question. What about the next time the system needs the governments help?

Maybe it’s a terrorist attack like 9/11, or a housing and jobs crisis like 2008, or a highly contagious pandemic like 2020. What the government has done each time is raise the bar, and set a precedent. Trillions of dollars in stimulus will do that. What happens during the next recession? If policy makers don’t respond as aggressively as we have seen they are capable, it will seem like they don’t care or even worse that they don’t have the tools to help. Now that we know what government can do, what stops the people or corporations from constantly expecting more and more help?

For a full breakdown of The American Rescue Plan Act and more on the precedent we’ve set and how it will impact the markets in the future, look for episode 10 of Understanding the Power of Money coming out on Wednesday

So What?

So how does this impact all of you?

- Have we gone to far? Have we set to high of a bar to meet during the next recession?

- It’s more than stimulus payments, be careful what the media tells you.

Stock market calendar this week:

Wednesday March 17th:

Federal Reserve Announcement Followed by Jerome Powell Press Conference @ 2PM

Thursday March 18th:

Initial and continuing Jobless Claims @ 8:30AM

Most anticipated earnings for this week