January 16, 2023

Forefront‘s Monday Market Update

Control

I have a type A personality, and although I am aware of it, it always surprises me when I am called out at unexpected times. This weekend, Priya, my eight-year-old daughter, called me out on it because she was supposed to make scrambled eggs on her own. Not with my help or her brother’s help, but entirely on her own. Naturally, I helped her crack the eggs into the bowl and then showed her how to whisk them to get them mixed up. I helped her measure out some milk to add and finally turned on the stove.

By this point, Priya had walked away and was lying on the ground, petting the dog. I asked her what had happened and why she wasn’t helping anymore. She pointed out that I was doing it, and there was nothing to help with. My own daughter called me out, and I usually would have dumped the egg mixture down the drain so she could start over, but inflation is a killer on egg prices these days.

I stepped back and told her the kitchen was hers and that my job was to make sure she was safe, but everything else was up to her. I may be biased, but these were the best eggs I have ever eaten.

It also made me think about a recent conversation I had with a member of my community who was also considering using me as their financial planner but giving up control was too hard for them.

Taking Control

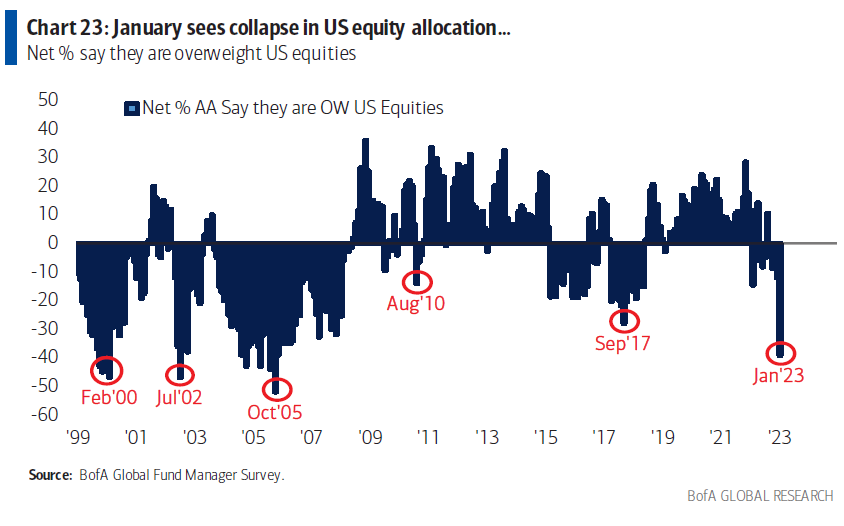

Your financial plan can be one of the most significant sources of stress in your day-to-day life without taking control of it. What that looks like is different for everyone, but the decision not to make, not make a decision, which is what I am seeing over and over right now. Look at the chart below, and you will notice that the percentage of US Equity allocation for investors is the lowest since 2005. A better way to look at this is that individual investors have fled the market in droves. Of course, one can argue that investors have shifted to more international equities, but a war in Eastern Europe makes me think people are more apt to invest in Ford than in Tata Motors overseas.

Why

Why is this happening? Panic. Panic is the simple answer, and I saw it yesterday when sitting down with a prospective client. They were 100% in cash. All of their retirement accounts sat in cash, and when I asked why, the answer was simple. They didn’t want to make a mistake. It gets worse, however.

We discussed their financial plan, going through their current and future income and their current and future expenses. We discussed a multitude of topics, all filling in their financial plan like a puzzle very neatly. That is until we came to the idea of how the accounts should be allocated. For those who know me or read my content, you know that the portfolio is the LAST thing I ever discuss. The plan is the product, not the portfolio!

Loss of Control

The loss of control with someone else making investment decisions within their portfolio was too much for them. Unfortunately, when it comes to money, the thought of someone else being able to set an investment allocation is considered a loss of control rather than taking back control. If your account is in cash, or you don’t open your statements because you fear making a mistake or seeing what is going on during market drops, you have already lost control.

Time

Understanding this idea of control when it comes to your financial plan takes time, and that time will breed trust with whomever you are considering. So often, I see advisors who run across people hesitant to give up control and don’t want to help because building that trust is too much time and effort for them. Like any relationship, make sure you find a professional willing to put in the time and effort to build a trusting bond that will help you recognize that you are taking back control of your financial plan, not giving it up.

So What?

So how does this impact all of you?

-

If you are paralyzed by fear, you have already lost control

-

Good advisors will take time to build trust.

Stock market calendar this week:

| MONDAY, JAN. 16 | |

| None scheduled. Martin Luther King Jr. Day | |

| TUESDAY, JAN. 17 | |

| 8:30 AM | Empire state manufacturing index |

| WEDNESDAY, JAN. 18 | |

| 8:30 AM | Retail sales |

| 8:30 AM | Retail sales ex motor vehicles |

| 8:30 AM | Producer price index, final demand |

| 9:15 AM | Industrial production |

| 9:15 AM | Capacity utilization |

| 10:00 AM | NAHB home builders’ index |

| 10:00 AM | Business inventories (revision) |

| 2:00 PM | Beige Book |

| THURSDAY, JAN. 19 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | Continuing jobless claims |

| 8:30 AM | Building permits (SAAR) |

| 8:30 AM | Housing starts (SAAR) |

| 8:30 AM | Philadelphia Fed manufacturing index |

| 1:15 PM | Fed Vice Chair Lael Brainard speaks |

| FRIDAY, JAN. 20 | |

| 10:00 AM | Existing home sales (SAAR) |

| 1:00 PM | Fed Gov. Christopher Waller speaks at Council on Foreign Relations |

Most anticipated earnings for this week:

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.