Forefront’s Monday Market Update

Russian sanctions explained

We wake up this morning to continued hostility and fighting from Russian forces as they continue their immoral invasion of Ukraine. Over the weekend, we watched and heard as the Ukrainian military held every single major city in Ukraine against Russia’s overwhelming armed forces.

As the fighting continues in Eastern Europe, we have heard quite a bit about various sanctions being levied against Russia. For many of us, we understand that sanctions are being put into place, but what exactly do those sanctions mean and do?

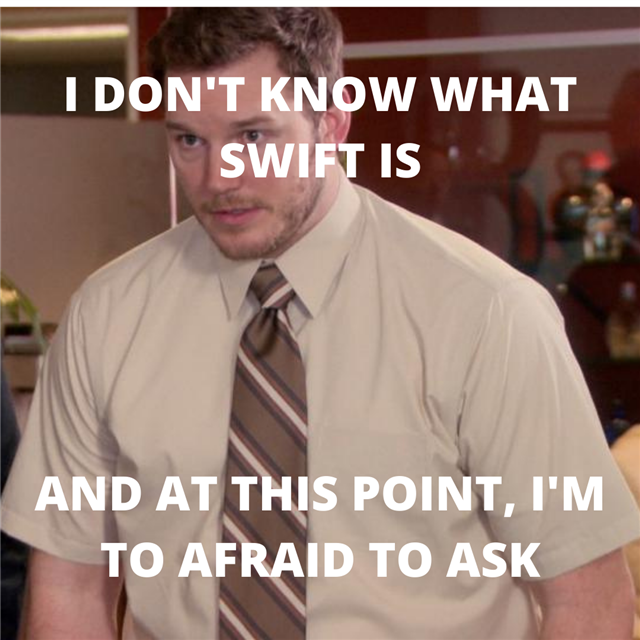

SWIFT

SWIFT is short for the Society for Worldwide Interbank Financial Telecommunications. It was formed in 1973, and now connects more than 11,000 financial institutions across 200+ countries.

Think of it as a messaging system that enables secure messaging across members. Today, there are an average of 40 million messages a day. Messages for orders, payment confirmations, FX exchange, and trades.

SWIFT doesn’t do any of the transfers or holding of funds, but is of critical importance to global money flow. Being removed from the SWIFT network, like what was done to most of Russia’s banks, creates a very precarious situation for the solvency of these institutions. We are already seeing the impact of this on the Russian people as lines have formed at banks and ATMs where Russians are withdrawing all of their money from the banks.

Russian Central Bank freeze

Much like our Central Bank, the Central Bank of Russia is responsible for stabilizing the country’s currency. As the Ruble plunges, the Russian Central Bank will buy Rubles to prop up its value. The way they have to buy those Rubles though is utilizing other assets, such as dollars, euros, gold, yuan, whatever.

In 2014 during Putin’s attack on Crimea, the Russian Central bank spent nearly 40% of its reserves in order to limit the drop.

This time, given the severity of sanctions, it is estimated that Russia will have to spend much more of its $640 billion dollars in reserve. There is just one slight problem.

The Russian Central Bank holds a substantial amount of those reserves in foreign banks, mostly in the West. The US and Europe have frozen those assets, so Russia will not be able to access those reserves to help prop up the Ruble. The really ominous part of this for Russia is that the Central Bank of Russia can’t really do anything about it.

We are used to thinking of our Central Bank as a printer of money, but the Central Bank of Russia can only print Rubles, and printing more of the currency doesn’t help to stabilize it, in fact it devalues it even further. If the Ruble crashes, and Russia runs out of accessible reserves, it is game over!

What does it mean?

These are the two major sanctions that have the ability to cripple the Russian economy as well as their war effort. It will have a ripple effect around the global economy, but prolonged military aggression will be far worse for global stock markets than sanctions that hit Russia particularly hard.

Cutting off Russian banks from being able to transact globally, as well as putting immense pressure on the Ruble and the Russian Economy, are extremely severe sanctions, and are something that only a week ago the general consensus was that they would not be put in place. What has happened since last Wednesday evening has been something many thought was impossible. The entire continent of Europe has united, with Germany pledging to spend double their TOTAL defense budget on just helping Ukraine. We saw a normally neutral country like Sweden step up and offer assistance to Ukraine

What we are watching unfold is heartbreaking, but the reality is all of our lives continue to march on. Our fears and anxiety over the stock market and our portfolios have only grown, and now coupled with a weekend of doom scrolling that many of us did, our emotions are at an all-time high. My team and I continue to monitor ALL of the portfolios, and are always ready to make changes when necessary. As I said in my letter on Thursday morning, ALL clients of Forefront Wealth Planning have not just money management in place, but an overall financial plan. We plan for anything and everything we can think of, we have cash positions inside of the portfolios, and stress cash reserves inside of savings accounts with all clients.

As we watch this crisis unfold, just know that anxiety over your portfolio and financial plan is completely normal, do not hesitate to reach out to me.

So What?

So how does this impact all of you?

- Let’s tune out the noise and focus on what really drive stock prices higher. Earnings and Fundamentals!

Stock market calendar this week:

| MONDAY, FEB. 21 | |

| Presidents Day holiday – None scheduled | |

| TUESDAY, FEB. 22 | |

| 9:00 AM | S&P Case-Shiller home price index (year-over-year change) |

| 9:00 AM | FHFA home price index (year-over-year change) |

| 9:45 AM | Markit manufacturing PMI (flash) |

| 9:45 AM | Markit services PMI (flash) |

| 10:00 AM | Consumer confidence index |

| WEDNESDAY, FEB. 23 | |

| None scheduled | |

| THURSDAY, FEB. 24 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | Continuing jobless claims |

| 8:30 AM | Gross domestic product revision (SAAR) |

| 8:30 AM | Gross domestic income (SAAR) |

| 10:00 AM | New home sales |

| FRIDAY, FEB. 25 | |

| 8:30 AM | Nominal personal income |

| 8:30 AM | Nominal consumer spending |

| 8:30 AM | PCE inflation (monthly) |

| 8:30 AM | Core inflation (monthly) |

| 8:30 AM | PCE inflation (year-over-year) |

| 8:30 AM | Real disposable income |

| 8:30 AM | Real consumer spending |

| 10:00 AM | UMich consumer sentiment (final) |

| 10:00 AM | 5-year inflation expectations (final) |

| 10:00 AM | Pending home sales |

Most anticipated earnings for this week: