August 1, 2022

Forefront‘s Weekly Market Notes

RINO (Recession in Name Only)

As I wrote about during the week of July 4th, the United States economy was already in a recession, and last week’s negative GDP number confirmed it. Although we will hear a lot of media and talking heads try to change the definition of a recession after all the mid-term elections are coming up. Don’t be fooled; two negative quarters of GDP is a good indication, but don’t think that the recession is only starting now; the economy has been in a recession for months now.

Impact on the Market

As the GDP number crossed the news line last week, we actually saw the market move higher. A move that surprised many, and prompted some clients to call me panicking. I didn’t waste the chance to point out that they were panicking while the market was going up. Investing for your future and being rational during times of chaos is very hard.

The stock market is a forward-looking tool, so seeing the market rise with the GDP number wasn’t much of a surprise. One piece of data isn’t going to matter in the grand scheme of overall market direction, but for a single day, it certainly did.

Now, we turn our attention to earnings, and more importantly retail earnings from the likes of Macy’s and Nordstroms. Earnings have continued to surprise to the upside and consumer spending remains strong. It is hard to imagine a deep or prolonged recession with consumer spending remaining high, and while the employment market remains robust. Let’s be clear though, the US economy is in a recession, and has been since early in Q2.

Impact to You

Other than psychological and emotional impact, the GDP number, and really whatever the stock market does in the next six months shouldn’t impact you at all. When I preach that the plan is the product, not the portfolio, this is exactly what I mean. If you are an older American either in retirement or getting ready to retire, a good chunk of your invested dollars should be in fixed income, with an even healthier chunk of dollars being set aside in cash. If you are a younger investor worried about college savings, paying for kids’ activities, or figuring out how to pay back student loans, the current environment has presented you a chance to eliminate debt and kick start wealth building with great investments on sale.

All of this speak about what the definition of a recession is, and if we are in one or not is just media mumbo-jumbo and political convolution to confuse and scare us. After all, the mid-term elections are around the corner, and the media and pollical machine will never waste an opportunity to confuse and scare Americans.

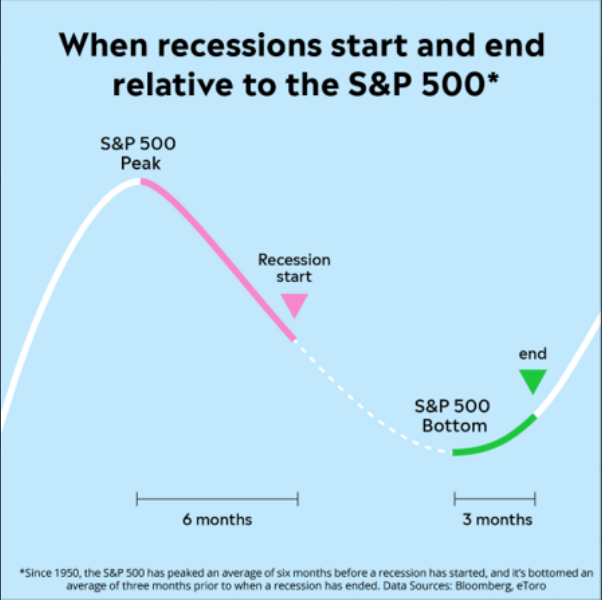

Don’t be confused or scared. A recession doesn’t mean immediate doom and is a very healthy and normal part of the American economic cycle. This isn’t to say that you should love what is happening right now, but the sky is not falling, and as the chart above points out, we are making our way to the other side.

So What?

So how does this impact all of you?

- There will be a lot of data this week, don’t take it at face value; read into it, or call me, and we can chat about it.

- The amount of data will make your head spin, don’t react emotionally, you will make a mistake.

Stock market calendar this week:

| MONDAY, AUG. 1 | |

| 9:45 AM | S&P U.S. manufacturing PMI (final) |

| 10:00 AM | ISM manufacturing index |

| 10:00 AM | Construction spending |

| TUESDAY, AUG. 2 | |

| 10:00 AM | Job openings |

| 10:00 AM | Quits |

| 10:00 AM | Rental vacancy rate |

| 10:00 AM | Homeowner vacancy rate |

| 11:00 AM | Real household debt |

| 6:45 PM | St. Louis Fed President James Bullard speaks |

| Time varies | Motor vehicle sales (SAAR) |

| WEDNESDAY, AUG. 3 | |

| 9:45 AM | S&P U.S. services PMI (final) |

| 10:00 AM | ISM services index |

| 10:00 AM | Factory orders |

| 10:00 AM | Core capital equipment orders (revision) |

| THURSDAY, AUG. 4 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | Continuing jobless claims |

| 8:30 AM | Trade deficit |

| 12 noon | Cleveland Fed President Loretta Mester speaks |

| FRIDAY, AUG. 5 | |

| 8:30 AM | Nonfarm payrolls |

| 8:30 AM | Unemployment rate |

| 8:30 AM | Average hourly earnings |

| 8:30 AM | Labor-force participation rate, ages 25-54 |

| 3:00 PM | Consumer credit |

Most anticipated earnings for this week:

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.