How We Helped a Client Unwind a $640K Position,

Without the $197K Tax Hit

I have a client who lives in Ramsey who in 2015, took a risk and invested $40,000 into a company he believed in: Nvidia. He didn’t trade. Didn’t follow daily market noise. He just held. Through every wave of fear and frenzy, he stayed put. Ten years later, his quiet conviction turned into something big. By early 2025, that one position had grown to about $640,000.

That kind of win comes with a hidden problem. Sitting under that total was $600,000 of unrealized gain. And a looming tax bill.

Selling it all in one shot meant giving up nearly a third of the gain to taxes. The combined federal capital gains rate (including the net investment income tax) comes to 23.8 percent. New Jersey adds another 8.97 percent for high earners. Altogether, you’re looking at nearly 33 percent.

That’s about $197,000 gone. Just for pressing “sell.”

Most people freeze at that number. He didn’t. He called us.

I run two firms that work together, Forefront Wealth Planning and Forefront Advisory. Planning and tax, side by side. No handoffs. No “looping in” your accountant. Just one coordinated plan that works across both sides of your financial life.

For this client, we built a two-year strategy to unwind his Nvidia position while keeping him invested and dramatically reducing the tax bill.

We started by replacing his traditional index exposure with a direct index. This gave us flexibility to harvest losses while still tracking the overall market. That’s how we kept him fully invested throughout the process, even as we reduced his risk.

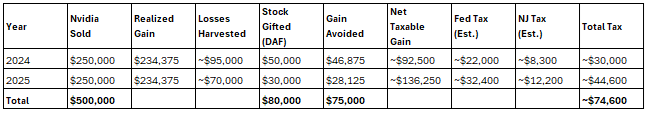

In year one, we sold $250,000 of Nvidia stock. His cost basis was low, so the realized gain was about $234,375. We harvested $95,000 in capital losses through his direct index, offsetting a large chunk of that gain. He and his wife already gave annually to charity, so we funded a donor-advised fund with $50,000 of Nvidia. That avoided $46,875 in embedded gain and generated a charitable deduction.

Net taxable gain for year one came to about $92,500. The federal tax bill landed around $22,000, with New Jersey adding about $8,300. Total tax for the year: roughly $30,000.

Year two followed the same playbook. We sold another $250,000, harvested $70,000 in losses, and donated another $30,000 to the donor-advised fund. That avoided another $28,125 in gain. After offsets, the taxable gain was about $136,250. Taxes came in around $44,600 total for that year.

How It All Added Up

Here’s the full tax breakdown:

After two years, Matt’s Nvidia exposure dropped from $640,000 to just $60,000. He sold $500,000 and gifted $80,000, without ever leaving the market. The total tax paid across both years was about $75,000.

Had he sold the same $500,000 without planning, he would have paid about $153,000 in taxes. If he had sold the full $640,000 all at once, he would have owed about $197,000.

This wasn’t theoretical savings. This was money he got to keep.

It worked because planning and tax happened in the same room. We mapped each sale to his goals and bracket. We tracked AGI, safe harbor payments, and wash-sale conflicts in real time. We made sure donor-advised fund lots and receipts were handled before deadlines, so nothing got missed. Every detail mattered.

Quiet work. Big results.

If you’re sitting on a large position or a long-overdue win, this is how you walk away smarter. Stay invested. Harvest losses. Gift shares if you already give. But more than anything, run the whole thing with a planner and a tax team who talk to each other.

My client didn’t just make a good investment. He had a plan to keep more of it.

That’s the part that counts.

Sources

-

Internal Revenue Service. Topic No. 409 Capital Gains and Losses.

-

State of New Jersey, Division of Taxation. 2025 Income Tax Rates.

-

Internal Revenue Service. Donor-Advised Funds – Frequently Asked Questions.

-

Morningstar. Understanding Direct Indexing: A Tax-Efficient Investment Tool.

-

National Philanthropic Trust. The 2024 Donor-Advised Fund Report.

-

Forbes. How to Harvest Tax Losses Without Running Afoul of the Wash Sale Rule.

-

Fidelity Investments. Capital Gains Tax: What You Need to Know.

NewEdge Advisors, LLC (“NewEdge Advisors”) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where NewEdge Advisors and its representatives are properly licensed or exempt from licensure. This website is solely for information purposes. Past Performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by NewEdge Advisors unless a client service agreement is in place.

Forefront Wealth Planning and its representatives do not provide tax or legal advice. Tax-law is subject to frequent change; therefore, it is important to coordinate with your tax advisor for the latest IRS rulings and specific tax advice, prior to undertaking an investment plan. Any tax or legal information provided here is merely a summary of our understanding and interpretation of some of the current income tax regulations and is not exhaustive. Investors must consult their tax advisor or legal counsel for advice and information concerning their particular situation.

Case studies presented are not indicative of all client experiences with Forefront Wealth Planning. Each client has unique circumstances and the case studies presented are only meant to illustrate common errors individuals make when handling their investments. Case studies presented should not be interpreted as a guarantee of future performance or success.

Stock market calendar this week:

| Time (ET) | Report |

| MONDAY, SEPT. 15 | |

| 8:30 AM | Empire State manufacturing survey |

| TUESDAY, SEPT. 16 | |

| 8:30 AM | U.S. retail sales |

| 8:30 AM | Retail sales minus autos |

| 8:30 AM | Import price index |

| 8:30 AM | Import price index minus fuel |

| 9:15 AM | Industrial production |

| 9:15 AM | Capacity utilization |

| 10:00 AM | Business inventories |

| 10:00 AM | Home builder confidence index |

| WEDNESDAY, SEPT. 17 | |

| 8:30 AM | Housing starts |

| 8:30 AM | Building permits |

| 2:00 PM | FOMC interest-rate decision |

| 2:30 PM | Fed Chair Powell press conference |

| THURSDAY, SEPT. 18 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | Philadelphia Fed manufacturing survey |

| 10:00 AM | U.S. leading economic indicators |

| FRIDAY, SEPT. 19 | |

| 2:30 PM | San Francisco Fed President Mary Daly speech |

Most anticipated earnings for this week

Did you miss our last blog?

Mastering the Mind: The Empty Boat and the Biases That Steer your Finances

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.