How Things Feel vs. How Things Are:

The Bias Costing You Real Money

There’s a quote that’s been living rent-free in my head for weeks now:

“We are terrible judges of how things are because we’re so wrapped up in how things feel.”

And once you see it, you can’t unsee it, especially when it comes to money.

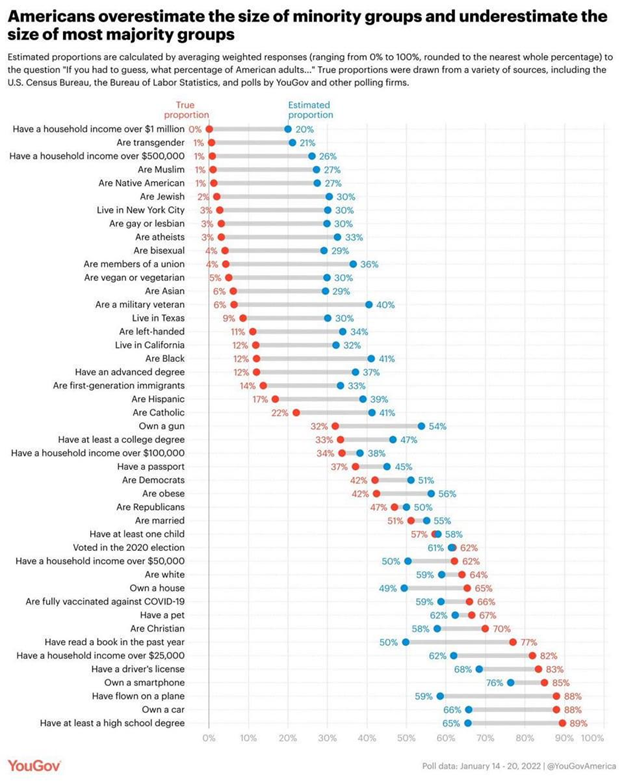

I recently came across a chart (see below) that highlights the inaccuracy of our estimates for basic statistics about Americans. We think 30% are gay or lesbian (it’s closer to 3%). We even believe 20% of U.S. households make over $1 million a year. The reality? Barely 1%.

So why do we get this stuff so wrong?

Because it feels true.

And that’s the problem. We’re not making financial decisions based on reality; we’re making them based on vibes.

Your Brain Wants Comfort, Not Accuracy

This is what behavioral economists refer to as the availability heuristic. If you see or hear something enough times, your brain starts to believe it’s common, even if the data says otherwise.

- You see a few people on Instagram remodeling their kitchens → “Everyone must be doing home upgrades.”

- Your friend’s friend hit it big on crypto → “Maybe I should get in before I miss the boat.”

- You keep seeing Merrill Lynch ads during football games → “They must be the best option.”

And because we confuse feeling familiar with being right, we end up making choices that look good on paper but don’t actually serve us.

Why Merrill Lynch Feels Safer Than an Independent Advisor

Let’s get personal for a second.

I run an independent financial planning firm. We don’t have TV ads. You won’t see our logo during a Yankees game. And yet, the most common hesitation I hear from prospective clients is:

“I’ve always felt more comfortable with the bigger firms.”

Why? Because they’re more capable? More personalized? Lower cost? Nope.

Because you’ve seen them. On TV. In magazines. On airport billboards. And in the absence of real due diligence, that visibility becomes a shortcut for trust.

Meanwhile, independent firms often devote more attention, planning, and resources, and have fewer conflicts of interest.

But we don’t feel safer. Because your brain isn’t trying to be accurate, it’s trying to be comfortable.

The Political Version: Lawn Signs and Winning Votes

Still think this is just a financial thing? Think again.

Political strategists have known this for decades. A candidate with more signs, more ads, and more name mentions will often win—even if their platform is as flimsy as a wet napkin.

Studies show that:

- Lawn signs can boost vote share by 1–2%

- In some precincts, seeing a name repeatedly was enough to sway undecided voters.

- Visibility creates familiarity, and familiarity creates trust—even if it’s totally unearned.

Sound familiar? It should.

That’s the same psychology Merrill Lynch uses. Or Apple. Or Tesla. Or any brand that wants you to feel better about buying into something without thinking too hard.

So, How Does This Cost You?

When you rely on how things feel instead of how they are, you end up:

- Overinvested in fads

- Underprepared for reality

- Overpaying for “trusted” brands

- Underutilizing better, less visible alternatives

You buy the expensive mutual fund because the company has a nice logo. You invest in tech stocks because they’re always in the news. You pass on a meeting with a fiduciary advisor because…well, you’ve never heard of them.

This isn’t judgment, it’s biology. But being aware of it? That’s your superpower.

The Antidote to Feeling: Facts, Fit, and Focus

Want to get your money right? Start asking better questions:

- “Is this actually a good fit for me, or just something I’ve seen a lot?”

- “Am I making this decision because of the data or because it feels familiar?”

- “If I didn’t recognize this name or logo, would I still trust it?”

That’s how you stop reacting to the noise and start building a plan based on your own values and goals, not someone else’s marketing strategy.

The Bottom Line

Our brains are wired for stories, not statistics. Feelings, not facts. That’s why Merrill Lynch feels safe. It’s why political signs sway votes. And it’s why we grossly overestimate the number of people who are millionaires.

But the good news? Once you realize this, you can take action.

You can pause. You can question. You can choose.

Because money doesn’t care how you feel, but your future self will care a whole lot about whether you got this right.

Sources:

- Green, Donald P., Jonathan S. Krasno, Alexander Coppock, Benjamin D. Farrer, Brandon Lenoir, and Joshua N. Zingher. “The Effects of Lawn Signs on Vote Outcomes: Results from Four Randomized Field Experiments.” Electoral Studies, Vol. 41, March 2016, pp. 143–150.

- Journalist’s Resource (Harvard Kennedy School Shorenstein Center). “Lawn Signs and Voter Behavior: Research Roundup.” March 15, 2016.

- Politico. “Yard Signs Really Can Swing an Election.” November 3, 2014.

- WHYY (PBS/NPR Affiliate). “Do Yard Signs Actually Work?” October 28, 2016.

- Tversky, Amos, and Daniel Kahneman. “Availability: A Heuristic for Judging Frequency and Probability.” Cognitive Psychology, Vol. 5, No. 2, 1973, pp. 207–232.

- YouGov America. “Perceptions vs. Reality: What Americans Get Wrong.” (Chart Data Source).

Stock market calendar this week:

| Time (ET) | Report |

| MONDAY, JUNE 9 | |

| 10:00 AM | Wholesale inventories |

| TUESDAY, JUNE 10 | |

| 6:00 AM | NFIB optimism index |

| WEDNESDAY, JUNE 11 | |

| 8:30 AM | Consumer price index |

| 8:30 AM | CPI year over year |

| 8:30 AM | Core CPI |

| 8:30 AM | Core CPI year over year |

| 2:00 PM | Monthly U.S. federal budget |

| THURSDAY, JUNE 12 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | Producer price index |

| 8:30 AM | Core PPI |

| 8:30 AM | PPI year over year |

| 8:30 AM | Core PPI year over year |

| FRIDAY, JUNE 13 | |

| 10:00 AM | Consumer sentiment (prelim) |

Most anticipated earnings for this week

Did you miss our last blog?

This Is What Happens When You Bet On Yourself

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.