Headlines, Bombs, and Balance Sheets:

What Military Strikes Really Mean for Your Portfolio

Over the weekend, the United States launched three strikes against Iranian targets, and tensions between Israel and Iran continued to simmer just below a boil. The headlines were jarring, the imagery intense, and the Twitter hot takes… predictably chaotic.

But while the world seems to tilt on its axis every time global powers clash, history tells a quieter story when it comes to your investments.

Let’s get something out of the way early: markets do not like uncertainty, but they also have short attention spans. And geopolitical conflict, for all its human cost and media drama, rarely delivers long-term disruption to a well-structured portfolio.

What the Market Did This Time

- The S&P 500 futures dipped less than 1%.

- Oil prices initially spiked 2–4% before retreating.

- Safe havens, such as U.S. Treasuries, gold, and even crypto currencies, saw modest movement.

In other words, a shrug. The market took a deep breath, looked around, and kept walking.

What the Market Usually Does

- One-Day Reaction: The average drop in the S&P 500 is between 0.4% and 1.5%.

- Three-Week Drawdown: Markets typically decline by 5–6% during the initial period of uncertainty.

- Six-Week Recovery: Markets typically recover to pre-event levels within six weeks.

- One-Year Return: The Average 12-month return following a geopolitical shock is around 7–8%.

Let’s Talk Oil and Inflation

Yes, military conflict in the Middle East often sends oil prices higher. That’s expected. Oil futures jumped modestly in response to this weekend’s strikes. But again, history offers some perspective.

During the Gulf War in 1990, oil prices soared; however, by the end of 1991, the S&P 500 had risen by over 26%. Similar stories played out after the 1973 oil embargo (though inflation was a bigger villain then) and following drone strikes on Saudi oil facilities in 2019.

Bottom line: Oil volatility is real, but markets are efficient at pricing in supply disruptions, and investors tend to overreact before returning to fundamentals.

What History Actually Teaches

If your investment strategy is rattled every time a bomb drops or a headline surges across your screen, you don’t have a strategy—you have a reaction.

Here’s a quick historical snapshot:

| Event | S&P 500 1-Day | 3-Week Avg | 12-Month Return |

| 9/11 Attacks | –4.9% | –11.6% | +0.40% |

| Gulf War Begins (1991) | –1.1% | +2.00% | +28.40% |

| U.S. Strike on Iran (2020) | –0.7% | +1.40% | +16.30% |

| Russian Invasion of Ukraine | –1.8% | –4.6% | 4.70% |

A little turbulence, followed by steady altitude gain. That’s the pattern.

Focus on What You Can Control

When it comes to investing, emotional responses can be costly. It’s far more valuable to focus on things within your control:

- Your asset allocation

- Your tax strategy

- Your spending and savings discipline

- Your long-term goals and time horizon

So, What Should You Do Right Now?

Probably nothing.

That’s the hard part about disciplined investing—it’s often boring. But boring is better than panicked. Better than reactive. Better than broke.

The market has survived wars, assassinations, recessions, pandemics, and debt ceiling crises. It will survive this, too.

If your financial plan is built on a foundation of headlines, don’t be surprised when it collapses during storms. Build on data. Build on discipline.

Sources:

- Deutsche Bank via Business Insider: “Here’s how stocks have historically reacted to geopolitical events”

- LPL Research: “Market Behavior During Geopolitical Shocks”

- Morningstar: “The Market’s Resilience in the Face of Conflict”

- JPMorgan: “Geopolitical Risks and Financial Markets”

- U.S. Energy Information Administration: Oil Price Data

- BlackRock: “Geopolitical Risk Dashboard”

- CNBC, Bloomberg, and Reuters market coverage from June 22–23, 2025

Stock market calendar this week:

| Time (ET) | Report |

| MONDAY, JUNE 23 | |

| 9:45 AM | S&P flash U.S. services PMI |

| 9:45 AM | S&P flash U.S. manufacturing PMI |

| 10:00 AM | Existing home sales |

| TUESDAY, JUNE 24 | |

| 9:00 AM | S&P Case-Shiller home price index (20 cities) |

| 9:15 AM | Cleveland Fed President Beth Hammack speaks |

| 10:00 AM | Consumer confidence |

| 10:00 AM | Fed Chair Powell testifies to House Financial Service Committee |

| WEDNESDAY, JUNE 25 | |

| 10:00 AM | New home sales |

| THURSDAY, JUNE 26 | |

| 8:30 AM | Advanced U.S. trade balance in goods |

| 8:30 AM | Advanced retail inventories |

| 8:30 AM | Advanced wholesale inventories |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | Durable-goods orders |

| 8:30 AM | Core durable-goods orders |

| 8:30 AM | GDP (second revision) |

| 9:00 AM | Cleveland Fed President Beth Hammack speaks |

| 10:00 AM | Pending home sales |

| FRIDAY, JUNE 27 | |

| 10:00 AM | Consumer sentiment (final) |

| 8:30 AM | Personal income |

| 8:30 AM | Personal spending |

| 8:30 AM | PCE index |

| 8:30 AM | PCE (year-over-year) |

| 8:30 AM | Core PCE index |

| 8:30 AM | Core PCE (year-over-year) |

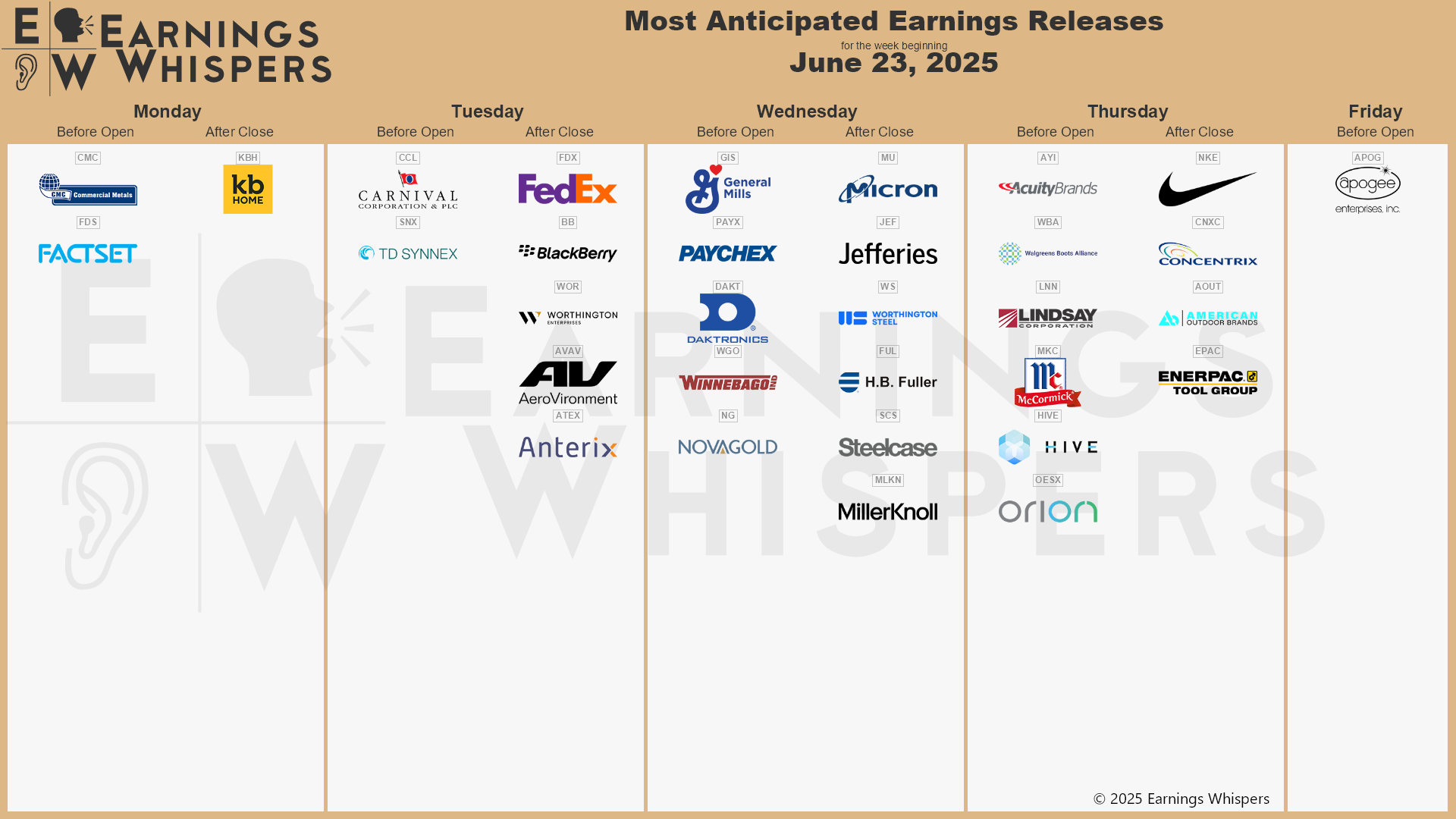

Most anticipated earnings for this week

Did you miss our last blog?

Stop Trying to Time the Market: Do This Instead

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.