Easy Come, Easy Go

Happy Labor Day everyone! Today, we all get a well-deserved day off, but that doesn’t stop the need for real news without the noise. Especially after last week.

Volatility came back into our lives after a seemingly endless climb to record highs for US Stock indexes. For many, their fear meters came back as well.

Traditional financial media was quick to jump on this, pushing the fear button all day Friday until markets began to rally off the lows. Almost immediately, news programs began trotting out guests on Friday afternoon chalking the market bounce up to short covering.

What really happened last week?

After the S&P hit another all-time high on Wednesday, we saw the index pull back over the course of Thursday and Friday by -4.4%.

- For the week the S&P500 was down -1.9%, after being up 7+% in August.

- Most of you didn’t experience that same level of volatility, regardless of what the media wants you to think.

- We saw major technology companies pull back drastically last week which was the major driver of the broader market pull back. Take a look at the chart below to see a heat map of the S&P500 for last week.

Easy Come, Easy Go

As I have written about before, the S&P500 is a market cap weighted index, meaning the larger the company the more it can move the entire index.

FAANG + MSFT have been the major driver of our current march to all time highs, but just like those companies can move the index higher, they have a major impact on the downside as indicated by the chart above.

- The S&P500 was down -3.3% on Thursday September 3rd, mainly driven by the large technology companies.

- A majority of the index was down less than -3.3% on Thursday

- This is why diversification works.

Discipline = Freedom

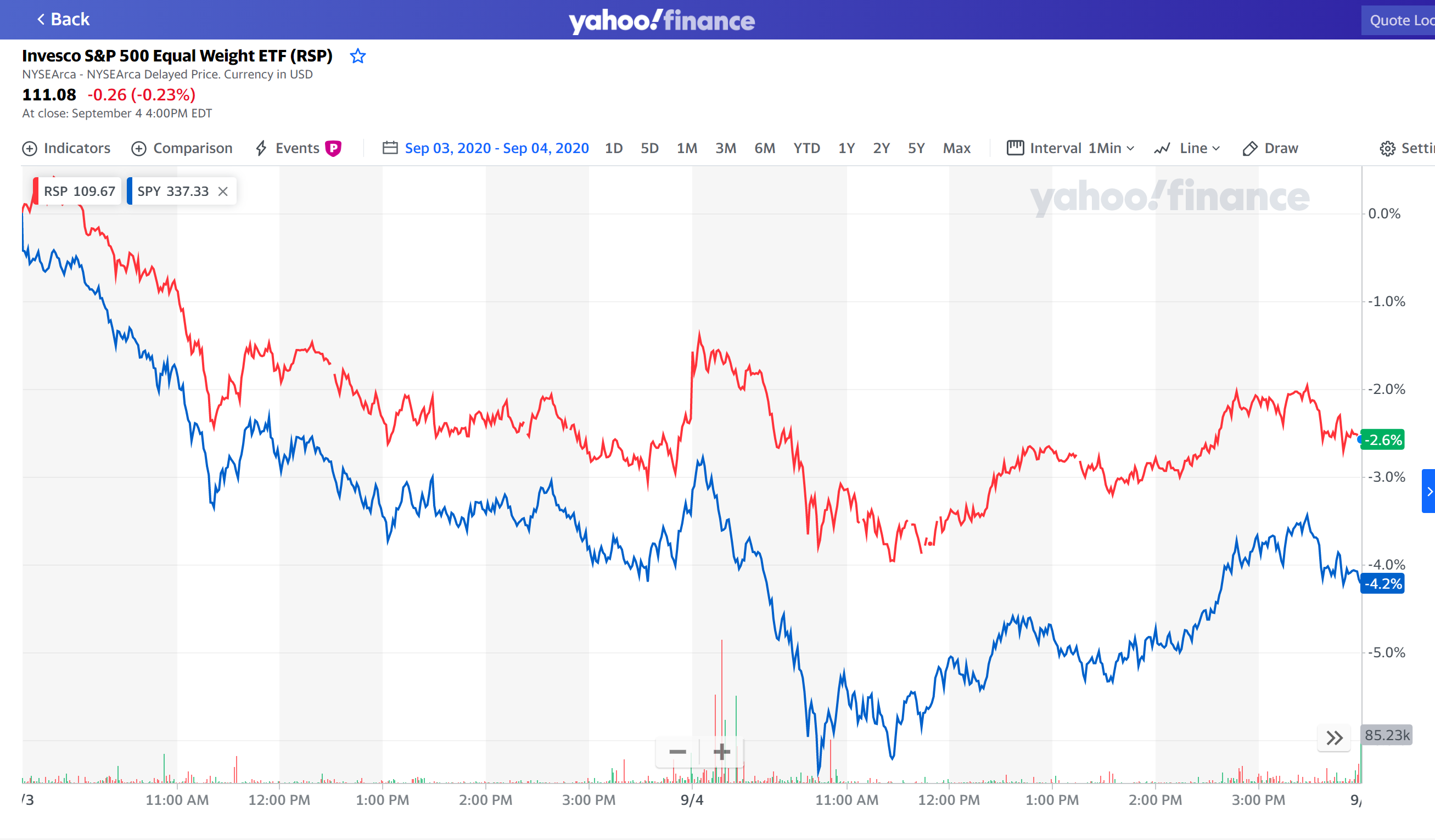

Last week was a small reminder of why you can’t just own what’s working at that moment. If you look at the chart above, it shows the difference in performance between the S&P500 and the equal weighted S&P500 for Thursday and Friday of last week.

Just like many people questioned why their portfolios weren’t going up as fast as the market, being diversified helps you avoid the downside risk as well.

Investing is about having a disciplined plan and sticking with it. That will give you the freedom to turn off CNBC/FOX Business and know that whatever might come up, your plan is prepared for it.

So What?

So how does this impact all of you?

- Just like we can’t get greedy on the way up, we can’t panic when there is volatility.

- The days of small market moves is over. 3-5% up or down in a day will happen more.

- FAANG+MSFT drove us higher, and has the ability to bring us back down

- The S&P500 is not a good indicator of the broad market. Stop comparing your portfolio to an index that doesn’t reflect how you SHOULD be invested.

- 33% of your money in 6 companies is not long term investing its gambling/trading.

- Concentrated positions feel great on the way up, but can cause panic very quickly on the way down.

- Investing is about avoiding euphoria and panic through a disciplined approach.

What to look forward to this week

Thursday Sept 10th, 2020

Initial and continuing jobless claims @ 8:30AM

Producer Price Index @ 8:30AM

Friday Sept 11th, 2020

Consumer Price Index @ 8:30AM

Core CPI @ 9:15AM

Most anticipated earnings for this week

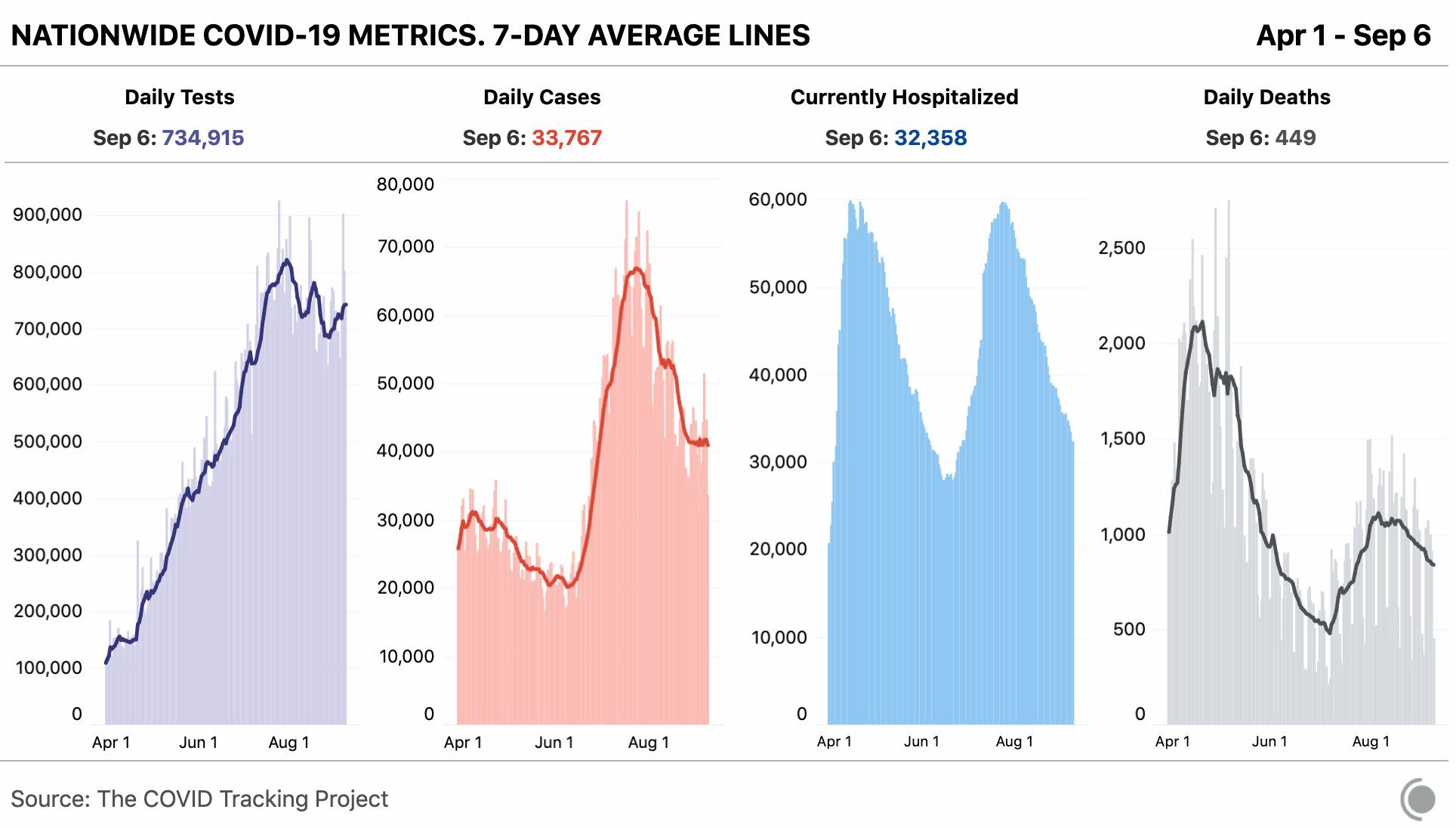

Latest Covid-19 Data

Don’t forget to check out last weeks episode of Forefront’s Friday Fun, and remember “its personal, not just business.”

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.