History never repeats itself. Man, always does – Voltaire

Have you been at dinner lately with friends, and one of them is telling you about their foray into day trading, or simply just bragging about their investments? They are bound to tell you about their outsized gains and incredible winners, but when the check comes, they have to use the bathroom!

We all like to brag, and its human nature to tell your peers about your triumphs all while leaving out your failures. This isn’t done maliciously, but you should never change your plan because you hear your peers bragging.

Bragging isn’t real, take it with a grain of salt

As the markets continue to recover from the Covid-19 shock, I’ve had a few conversations with people about abandoning their strategies for a more “growth-oriented approach” as some have put it.

I am not opposed to growth, especially if it fits with where you are in your overall financial and life plans. What I have noticed though is that “growth oriented” is actually code for a strategy of timing the market and getting in and out in hopes of giving a quick boost to overall returns.

Good Days and Bad Days

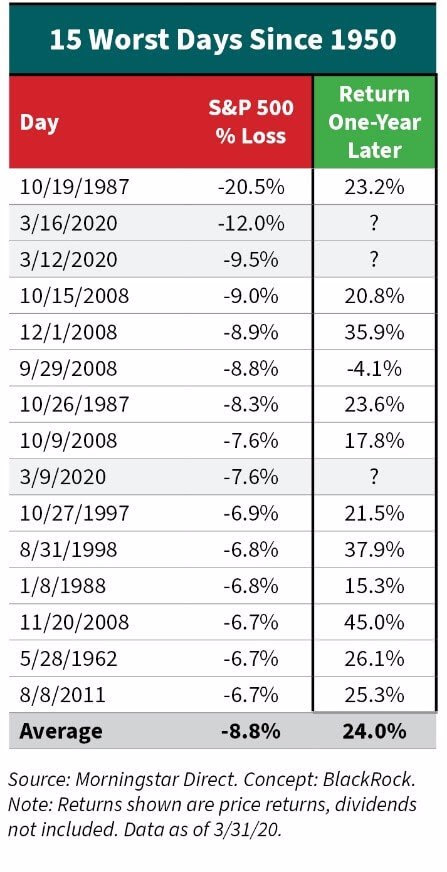

The best days and the worst days in the market since 1950 happen surprisingly close to eachother. 2020 is a great example, with one of our worst days coming on March 12th, 2020 when the S&P lost -9.5%.

It’s okay though, because the following day, March 13th, the S&P was up +9.3%. Take a close look at the numbers from March of 2020 below, and you will see why trying to time the market is not skill, but rather pure luck!

Missing the boat

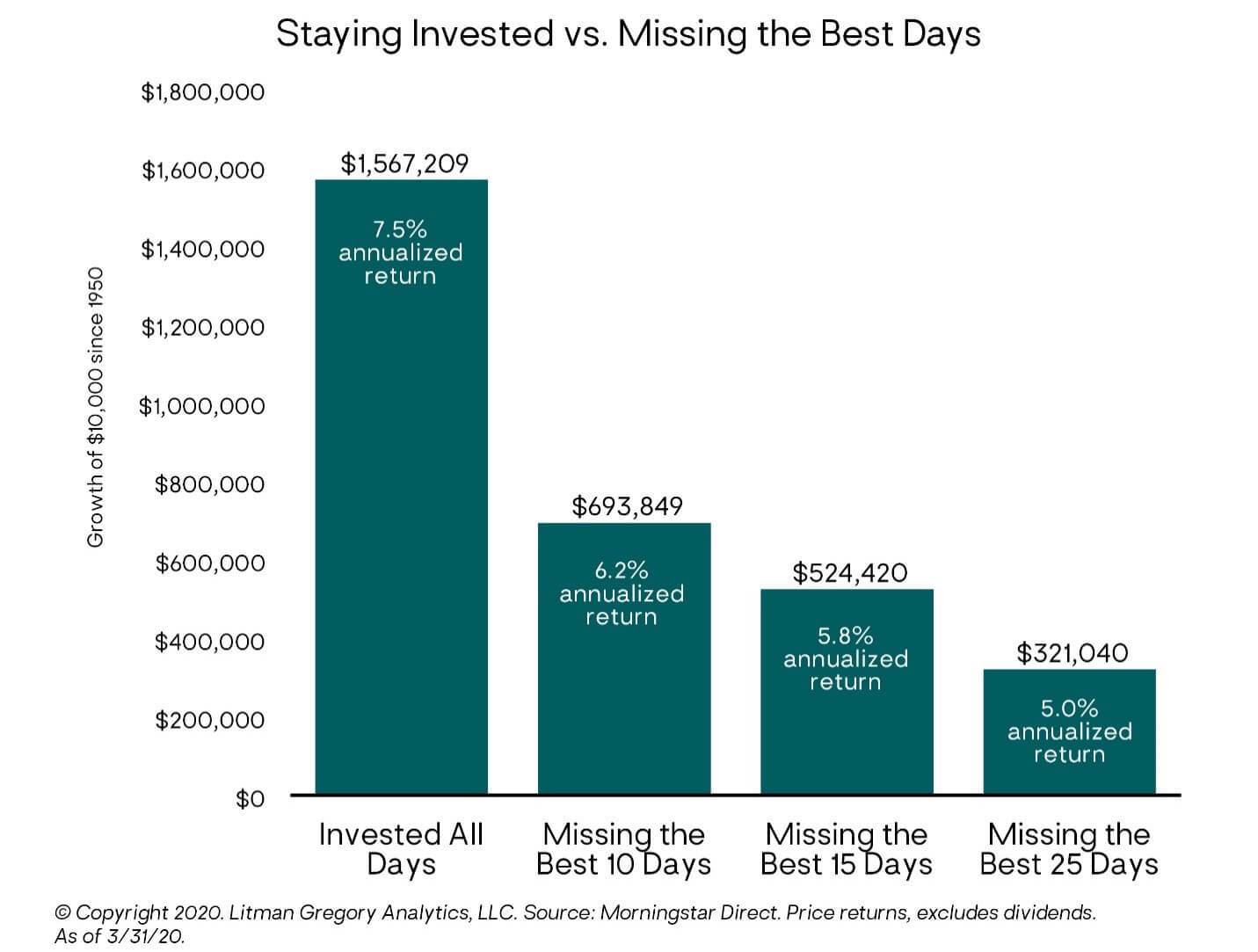

There have been more than 17,500 trading days since 1950. All you have to do is miss the 10 best days and your returns are cut by nearly $1 Million Dollars!

For every friend who tells you about their amazing trading skills, you have another friend who was so paralizing by 2008 that they never reinvested a bulk of their money. Fear and greed are financial plan killers.

The problem with cookie cutter.

Investing is a psychological exercise more than anything, with our own unique emotions driving the bus. Remember what I wrote last week, we all think other peoples investing idiosyncrasies are nuts, because we don’t want to look at our own.

The issue is that most “financial advisors” have a job title that sounds helpful, but their job is to take a cookie cutter portfolio and make it fit to you, like sticking a square peg into a round hole.

What a homecoming suit can teach you about financial planning

I remember going to my first ever Homecoming dance in high school and wearing my father’s old suit. It was odd fitting, with the jacket to big in the shoulders and sleeves, the pants to long, but somehow skin tight around my thighs and waste. Oh, and let’s not forget the triple pleats, my goodness those pleats!

I had a good time, but not the best time, because I couldn’t stop thinking about my pants ripping, or my jacket swallowing me up with its size. I had a reoccurring thought of something horribly embarrassing happening to me and it gave me a constant sense of worry and dread. This is exactly what it feels like to be a square peg being forced into a round hole with your financial plan.

Customization is key, and not as hard as they want you to think

A customized financial plan doesn’t mean that each individual stock, bond, ETF, or Mutual fund is just bought for you. What it means is that your risk tolerance, current and future cash flow, and overall goals are all considered when creating an investment and financial plan for you. It has to fit like a well-tailored suit, contoured to you specifically. That plan also needs to be adjusted and refitted to you on an ongoing basis, just because a suit fits you when you are 28 doesn’t mean it will fit when you are 58. The same goes for financial plans.

So, I shouldn’t abandon value for growth?

We all want clear black and white answers, but investing is full of grey. I can send you 10 pieces of research all done by Value managers showing how much better Value has out performed growth. If we ask Growth managers, they will point out that yes, value has outperformed growth…….. if you look at the past 50 years, but not the past 20 years.

There is no reason to abandon one strategy for the other, what you are better off doing is discussing your feelings with your financial advisor, and adjusting your plan together to reflect your goals. All portfolios will have a mix of growth and value, what that mix is for you will be unique. Make sure your advisor isn’t a suit salesman putting you into the first thing that sort of fits. They need to be a tailor, creating the perfect fit for you.

So What?

So how does this impact all of you?

- Missing just some of the best days in the market can alter your plan forever

- Stop listening to your friends brag, they aren’t telling you about their losers.

- If your advisor has you in a cookie cutter portfolio, RUN! It MUST be custom tailored to your unique life.

- Find a tailor not a suit salesman

What to look forward to this week

Wednesday Sept 30th, 2020

ADP employment report @ 8:15AM

Thursday October 1st, 2020

Initial and continuing jobless claims @ 8:30AM

Friday October 2nd, 2020

Non-Farm Payrolls @ 8:30AM

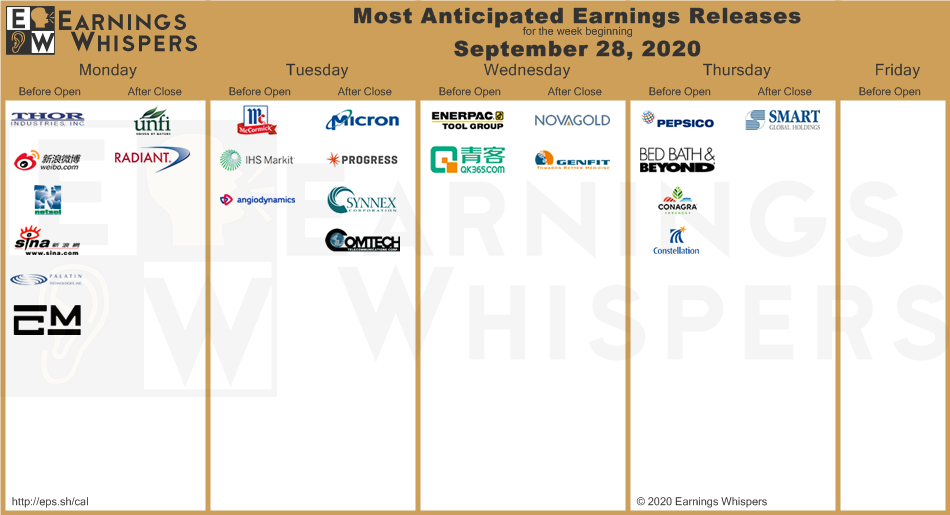

Most anticipated earnings for this week

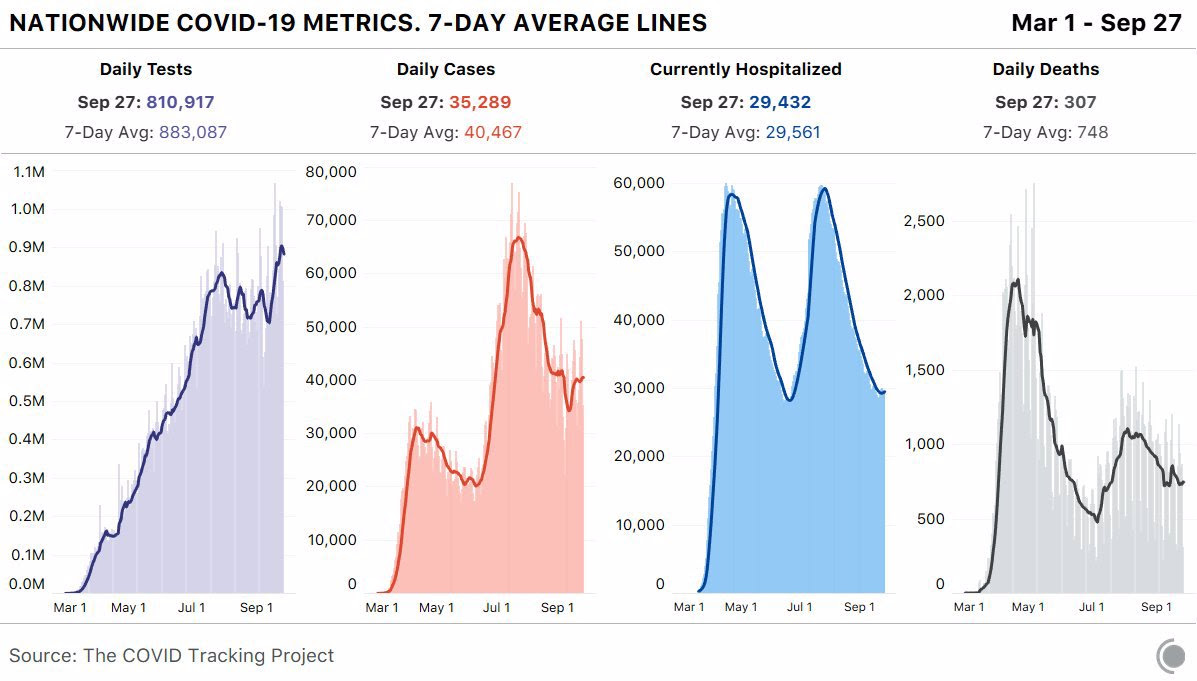

Latest Covid-19 Data

Don’t forget to check out last weeks episode of Forefront’s Friday Fun, and remember “its personal, not just business.”