What the heck is Flexible 2% Average Inflation Targeting (FAIT)?

Last week Federal Reserve Chairman Jerome Powell announced a change to the structural framework that guides the direction of monetary policy. I took that right from Forbes and even I am not sure what that means. Let’s break it down.

The Fed Mandate

- Keep employment up

- Keep inflation down

Sounds easy, but typically there is a trade off between the two. When we have high employment, it tends to lead to higher inflation, thus requiring The Fed to raise interest rates. That is not the world we live in today.

A New World

Over the past 10 years employment has skyrocketed while inflation has remained relatively stable, typically coming in between 1.5-2.5% on a year over year basis. This has happened while not only employment has increased, but so has personal income and consumer spending. The historical connection between high employment and inflation has not come to fruition over the past decade.

Then what is FAIT?

Instead of needing inflation to maintain a 2% or lower mark, they will let inflation run hot, above 2% for a bit so that the average inflation over a period of time comes in at 2%. This has led many to believe a few key takeaways.

- The Fed is signaling its commitment to growth.

- Interest rates will stay low for longer, because they won’t need to rise pre-emptively.

- The Fed is clearly signaling that unemployment cannot fall to low.

- Previously, as unemployment fell it was a sign of economic expansion which could lead to inflation, so interest rates would rise. That is no longer the case.

Does this really matter?

It might seem like a very subtle shift in language to most of us, but consider that the history of the Fed has been all about keeping inflation under control. This is a clear indication that we are living in a new world, and a major shift was necessary.

So What?

So how does this impact all of you?

- Interest rates will stay low for longer, meaning lower mortgage rates, and rates to borrow money in general, which is good for economic activity.

- Employment and inflation are not attached at the hip. We can have a robust labor market without having out of control inflation.

- The Fed is committed to growth and economic expansion.

What to look forward to this week

Wednesday Sept 2nd, 2020

ADP Employment Report @ 8:15AM

Fed Beige Book @ 2:00PM

Thursday Sept 3rd, 2020

Initial and continuing jobless claims @ 8:30AM

Trade Defecit @ 8:30AM

Friday Sept 4th, 2020

Non Farm Payrolls @ 8:30AM

Unemployment Rate @ 8:30AM

Most anticipated earnings for this week

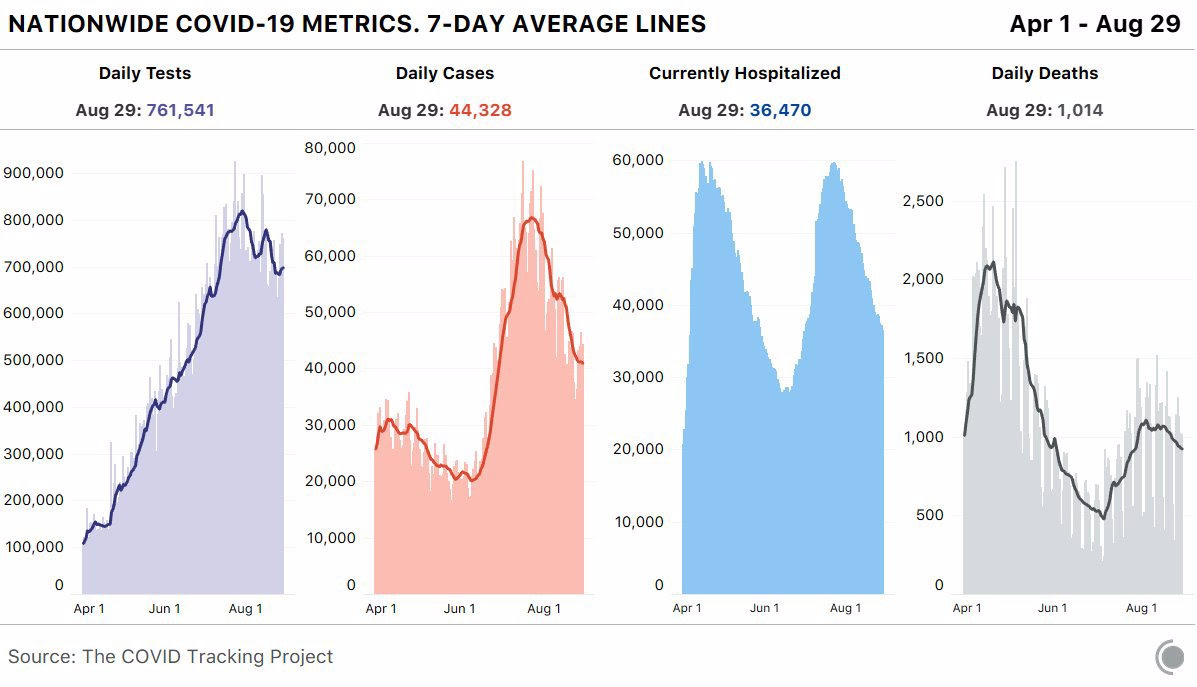

Latest Covid-19 Data

Don’t forget to check out last weeks episode of Forefront’s Friday Fun, and remember “its personal, not just business.”

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.