Forefront’s Market Notes:

October 7th, 2024

Stocks were essentially unchanged last week as geopolitical tensions added some volatility to an otherwise quiet trading week.

The Dow Jones Industrial Average was flat (+0.09 percent), while the Standard & Poor’s 500 Index ticked up 0.22 percent. The Nasdaq Composite also was flat (+0.10 percent). The MSCI EAFE Index, which tracks developed overseas stock markets, was a bit more unsettled by the geopolitical events, dropping 3.74 percent.1,2

Stocks Flat, Oil Spikes

Stocks posted modest gains on Monday, encouraged by upbeat comments in a speech by Fed Chair Jerome Powell. However, the modest gains pushed the S&P 500 and Dow to fresh records.3

As Middle East tensions escalated on the first day of October, stocks fell, bond yields rose, and oil prices rose as the news unfolded.4

On Wednesday, all three averages were flat. An ADP report showed higher-than-expected private sector job growth—a metric investors focus on. Oil prices continued to rise as investors watched the developments in the Middle East.5,6

Then, on Friday, stocks rallied after the Labor Department’s September jobs report topped expectations.7

.Source: YCharts.com, October 5, 2024. Weekly performance is measured from Monday, September 30, to Friday, October 4. TR = total return for the index, which includes any dividends as well as any other cash distributions during the period. Treasury note yield is expressed in basis points.

Jobs Out Front

The Labor Department’s jobs report gave investors some much-welcomed insights into the jobs market. At its September meeting, the Fed indicated it was watching the jobs market as closely as inflation, so updates on the jobs market are now considered as important as inflation reports.8

The report showed employers added 254,000 jobs, about 100,000 more than economists expected. It also showed that unemployment ticked down to 4.1 percent last month.9

Protect Your Financial Safety in Case of a Natural Disaster

No matter where you live, you should be aware of possible natural disasters in your area and plan accordingly by considering the following tax tips:

- Update your emergency plan.

- Create electronic copies of all important documents.

- Document your valuables. Documenting ahead of time makes it easier to claim insurance and tax benefits if a disaster strikes.

- You can call the IRS at 866-562-5227 with any natural disaster-related questions. The agency can provide copies of previous tax returns, order transcripts showing most line items, and more.

- Net personal, casualty, and theft losses may be deductible if attributable to a federally declared disaster.

*This information is not intended to be a substitute for specific, individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS10

Footnotes and Sources

1. The Wall Street Journal, October 4, 2024

2. Investing.com, October 4, 2024

3. CNBC.com, September 30, 2024

4. The Wall Street Journal, October 1, 2024

5. The Wall Street Journal, October 2, 2024

6. The Financial Times, October 3, 2024

7. The Wall Street Journal, October 4, 2024

8. The Wall Street Journal, October 2, 2024

9. The Wall Street Journal, October 4, 2024

10. IRS.gov, July 24, 2024

11. Daily Burn, July 24, 2024

Stock market calendar this week:

| Time (ET) | Report |

| MONDAY, OCT. 7 | |

| 1:00 PM | Fed Governor Michelle Bowman speaks |

| 3:00 PM | Consumer credit |

| 6:30 PM | St. Louis Fed President Alberto Musalem speaks |

| TUESDAY, OCT. 8 | |

| 3:00 AM | Fed Governor Adriana Kugler speaks in Europe |

| 6:00 AM | NFIB optimism index |

| 8:30 AM | U.S. trade deficit |

| 12:45 PM | Atlanta Fed President Raphael Bostic speaks |

| 7:30 PM | Federal Reserve Vice Chair Philip Jefferson speaks |

| WEDNESDAY, OCT. 9 | |

| 8:00 AM | Atlanta Fed President Raphael Bostic gives welcoming remarks |

| 9:15 AM | Dallas Fed President Lorie Logan speaks |

| 10:00 AM | Wholesale inventories |

| 10:30 AM | Chicago Fed President Austan Goolsbee gives opening remarks |

| 12:30 PM | Federal Reserve Vice Chair Philip Jefferson speaks |

| 2:00 PM | Minutes of Fed’s September FOMC meeting |

| 6:00 PM | San Francisco Fed President Mary Daly speaks |

| THURSDAY, OCT. 10 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | Consumer price index |

| 8″30 am | Core CPI |

| 8:30 AM | CPI year over year |

| 8:30 AM | Core CPI year over year |

| 9:15 AM | Federal Reserve Governor Lisa Cook speaks |

| 10:30 AM | Richmond Fed President Tom Barkin speaks |

| 11:00 AM | New York Fed President John Williams speaks |

| FRIDAY, OCT. 11 | |

| 8:30 AM | Producer price index |

| 8:30 AM | Core PPI |

| 8:30 AM | PPI year over year |

| 8:30 AM | Core PPI year over year |

| 9:45 AM | Chicago Fed President Austan Goolsbee gives opening remarks |

| 10:00 AM | Consumer sentiment (prelim) |

| 10:45 AM | Dallas Fed President Lorie Logan speaks |

| 1:10 PM | Federal Reserve Governor Michelle Bowman speaks |

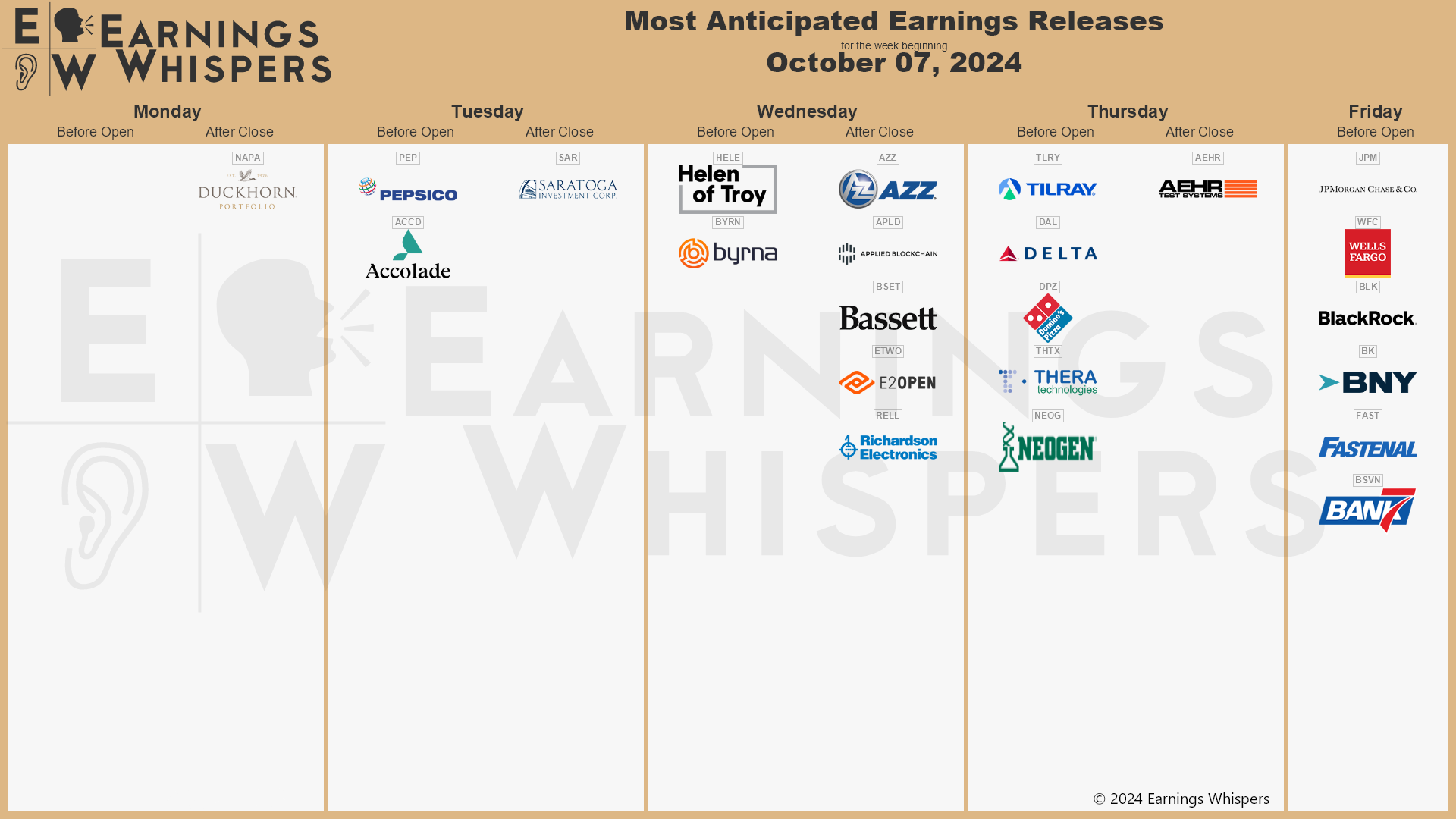

Most anticipated earnings for this week:

Did you miss our last blog?

Forefront Market Notes: September 30th

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.