Forefront’s Market Notes

March 31st, 2025

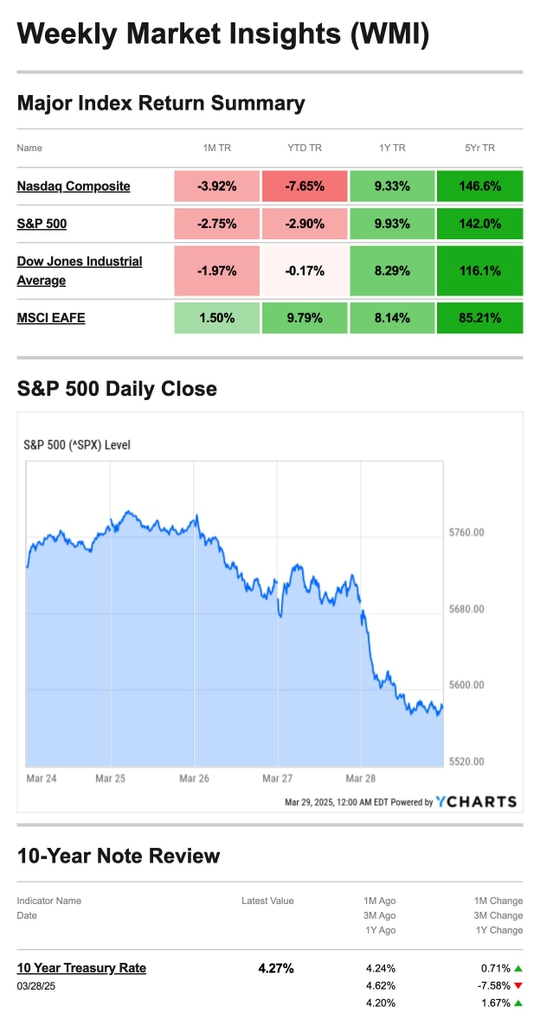

Stocks moved lower last week as investors swung from exuberance to disappointment on news over tariffs and inflation.

The Standard & Poor’s 500 Index fell 1.53 percent, while the Nasdaq Composite Index retreated 2.59 percent. The Dow Jones Industrial Average slid 0.96 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, declined 1.29 percent.1,2

An Up and Down Week

Stocks started the week with a sharp rally after the White House said it may “give a lot of countries breaks” on reciprocal tariffs. The positive momentum continued into Tuesday, with the Nasdaq and S&P 500 outpacing the Dow.3

Then, midweek, news that the White House was planning additional tariffs on all cars made outside the U.S. rattled markets.4,5

On Friday, investors reacted to a warmer-than-expected inflation report and lower consumer sentiment, putting further pressure on stocks as the week closed.6

Source: YCharts.com, March 29, 2025. Weekly performance is measured from Monday, March 24, to Friday, March 28. TR = total return for the index, which includes any dividends as well as any other cash distributions during the period. Treasury note yield is expressed in basis points.

Noise vs Signal

There can be a lot of noise in the market from time to time. This can make it hard for investors to interpret information as they search for the actual signal.

Last week, investors were trying to interpret the White House decision to impose tariffs on all cars and some car parts made outside of the U.S. While some automakers are domestic and others are foreign-based, the question is whether companies will absorb the additional costs, pass them on to consumers, or look to build factories in the United States.7

Separating the noise from the signal may take time, which can be more challenging when the markets react to new tariff updates as they are announced.

Things You Can Do on the IRS Website

While the IRS website might not be in your top bookmarks, the website is helpful for a lot of things regarding taxes. Here are just a few things you can do on the site:

- Use Free File to access brand-name tax software and online fillable forms.

- Use the IRS e-file system: a safe, easy, and common way to file your tax return.

- Check the status of your tax refund.

- Find out how to make payments electronically to pay your federal taxes. You can use a credit or debit card or enroll in the US Treasury’s Electronic Federal Tax Payment System to pay your taxes.

- Get tax forms and publications, including helpful tips for frequently asked questions.

This information is not a substitute for individualized tax advice. Please discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS8

Footnotes and Sources

1. The Wall Street Journal, March 28, 2025

2. Investing.com, March 28, 2025

3. CNBC.com, March 25, 2025

4. CNBC.com, March 26, 2025

5. CNBC.com, March 27, 2025

6. The Wall Street Journal, March 28, 2025

7. MarketWatch.com, March 27, 2025

8. IRS.gov, August 22, 2024

Stock market calendar this week:

| Time (ET) | Report |

| MONDAY, MARCH 31 | |

| 9:45 AM | Chicago Business Barometer (PMI) |

| TUESDAY, APRIL 1 | |

| 9:00 AM | Richmond Fed President Thomas Barkin speaks |

| 9:45 AM | S&P final U.S. manufacturing PMI |

| 10:00 AM | Construction spending |

| 10:00 AM | ISM manufacturing |

| 10:00 AM | Job openings |

| TBA | Auto sales |

| WEDNESDAY, APRIL 2 | |

| 8:15 AM | ADP employment |

| 10:00 AM | Factory orders |

| 4:30 PM | Fed Governor Adriana Kugler speaks |

| THURSDAY, APRIL 3 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | U.S. trade deficit |

| 9:45 AM | S&P final U.S. services PMI |

| 10:00 AM | ISM services |

| 12:30 PM | Fed Vice Chairman Philip Jefferson speaks |

| 2:30 PM | Fed Governor Lisa Cook speaks |

| FRIDAY, APRIL 4 | |

| 8:30 AM | U.S. employment report |

| 8:30 AM | U.S. unemployment rate |

| 8:30 AM | U.S. hourly wages |

| 8:30 AM | Hourly wages year over year |

| 11:25 AM | Fed Chairman Jerome Powell speaks |

| 12:00 PM | Fed Governor Michael Barr speaks |

| 12:45 PM | Fed Governor Christopher Waller speaks |

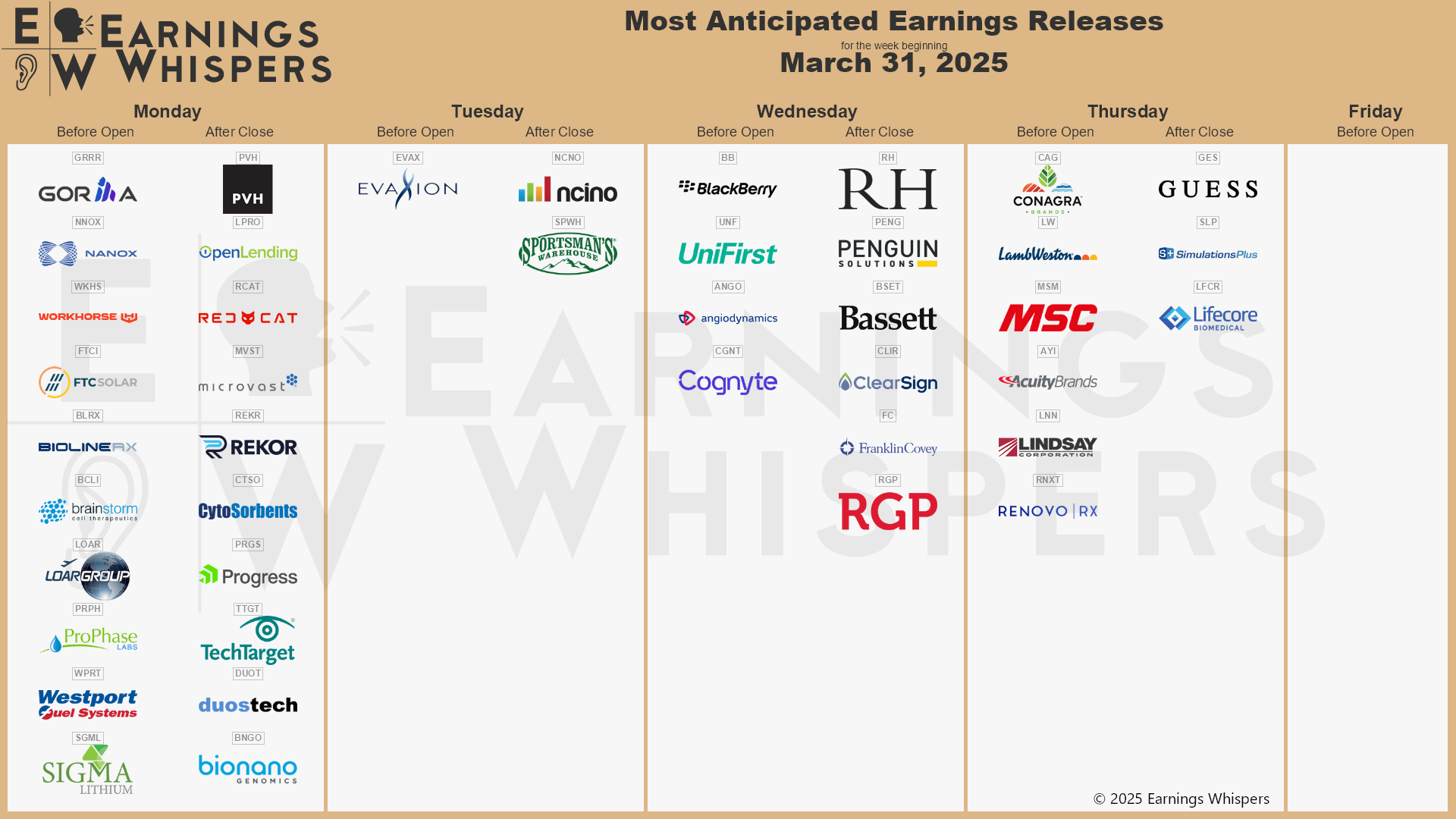

Most anticipated earnings for this week

Did you miss our last blog:

What Does Enough Look Like For You?

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.