April 3, 2023

A Client Story

I met a family this weekend whose mother had been following me for nearly a year, reading my content, and engaging with me on social media, but her son-in-law reached out to me to set up a meeting. So, we set it up for Saturday so he and his wife, the older couple’s daughter, could also be there.

When we sat down, I was confronted with a scenario of early financial luck misconstrued as success and skill and the two decades of bad investment decisions that followed. I was given permission to tell this story by the family.

Dot-Com Luck

The story begins in 2000 when the Husband and Wife were in the midst of their careers, and their daughter was nine years old. Oddly, their son-in-law and daughter grew up in the same town, not being friends as children but reconnecting in college. The husband was laid off from his job in late 1999, and as you should, he moved his 401K into an IRA he set up. But, as LUCK (not skill) would have it, he sold his 401K positions, moved the cash, and never reinvested the money. As the husband and wife were telling the story, he indicated this was strategic, but the wife pointed out that he only realized the money was in cash in 2004. So they reinvested the money into the market in 2004.

GFC 2008

During the Great Financial Crisis in 2008, the couple watched their portfolio fall with the market by nearly 40%, and the fear became too much. However, they felt they didn’t miss out on much being in cash during the dot-com crash, so they decided to move to cash. It wasn’t until five years later that they put that money back into the market with the help of their future son-in-law.

The money going to cash in 2000 happened out of coincidence, and it went to cash BEFORE the market had really started to fall, unlike in 2008 when they went to cash AFTER the market had already fallen. Unfortunately, this family isn’t alone; I have met dozens and dozens of families who all made the same mistake. Fear is one of the most powerful emotions we have.

Covid

Most of us know where this story is going, but once the market fell in March 2020, this husband and wife again went to cash, which is where they remain today. Dumb luck in 2000 gave them both a sense that they could time the market, but instead of trying to do that based on ANY data, they found their decisions purely on their emotion of fear.

Fall Out

Sitting down with the whole family this weekend, we discussed what retirement income will look like. It became painfully evident that although they would be okay, their plans for travel and other activities in retirement would have to be paired down.

We developed a plan to get their money back invested, but with an appropriate fixed income component. The focus of our plan development wasn’t on how to make the most money; instead, we dissected what the couple needed out of their allocation so that they would remain invested through ups and downs.

Past decisions based on emotions have certainly changed their retirement, but they are one of the lucky ones. They will still be able to retire and be relatively fulfilled; many who made emotional decisions won’t be that lucky.

So, What

If there were only one way to be successful as an investor, everyone would do it. Success can occur with several strategies, some of which we may have yet to consider. Investing failure happens in only a few ways.

- Emotions guide your investment plan. Fear and greed will derail success every time.

- Trying to find the next hot investment or whatever the fad investment of the week is.

- Not having a plan

- Overconfidence and thinking you are smarter than the market. The greatest investors in the world either know they aren’t smarter than the market or underperform the market year after year, but have a good publicist, so CNBC lets them back on TV as pundits.

I am often asked what a financial planner does if not try and beat the market, and I point out the list above.

Remaining even-keeled and staying invested is only part of it, but it wouldn’t make any difference if we didn’t have a plan. As I tell all the families I serve, the plan is the product, not the portfolio. You aren’t buying a portfolio from me; you are buying a process.

Stock market calendar this week:

| MONDAY, April 3 | |

| 8:30 AM | St. Louis Fed President Bullard speaks |

| 9:45 AM | S&P final U.S. manufacturing PMI |

| 10:00 AM | ISM manufacturing |

| 10:00 AM | Construction spending |

| 4:15 PM | Fed Gov. Cook speaks |

| TUESDAY, April 4 | |

| 10.00 am | Factory orders |

| 10:00 AM | Job openings |

| 6:00 PM | Cleveland Fed President Mester speaks |

| WEDNESDAY, April 5 | |

| 8:15 AM | ADP employment |

| 8:30 AM | U.S. trade balance |

| 9:45 AM | S&P final U.S. services PMI |

| 10:00 AM | ISM services |

| THURSDAY, April 6 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | Continuing jobless claims |

| 10:00 AM | St. Louis Fed President Bullard speaks |

| FRIDAY, April 7 | |

| 8:30 AM | U.S. employment report |

| 8:30 AM | U.S. unemployment rate |

| 8:30 AM | Average hourly wages |

| 8:30 AM | Average hourly wages (year over year) |

| 3:00 PM | Consumer credit |

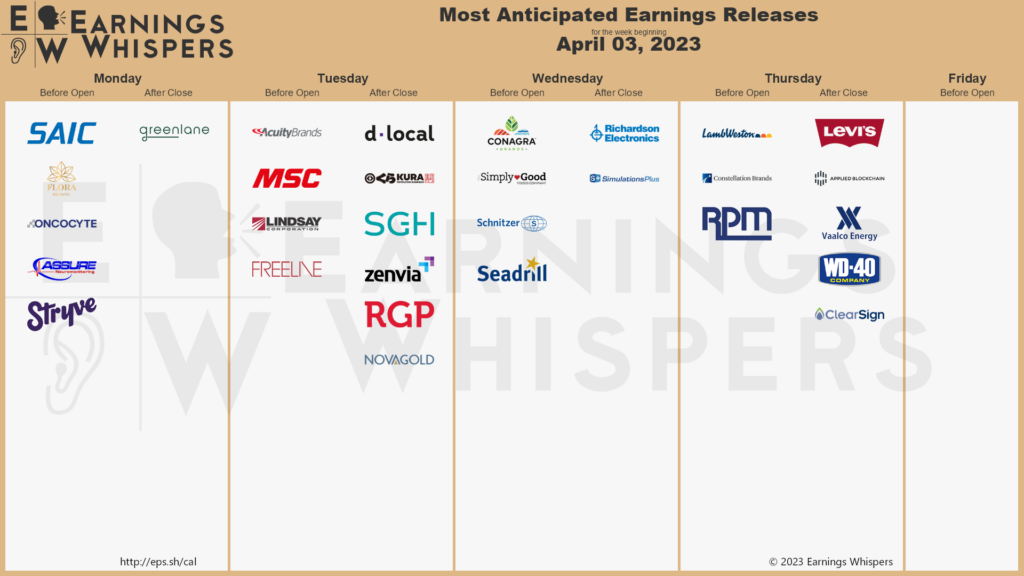

Most anticipated earnings for this week:

Did you miss our blog last week?

The Conundrum Of Happiness

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.