Forefront’s Market Notes

January 20th, 2025

Stocks roared back last week, fueled by upbeat Q4 corporate reports and economic news that stalled inflationary fears.

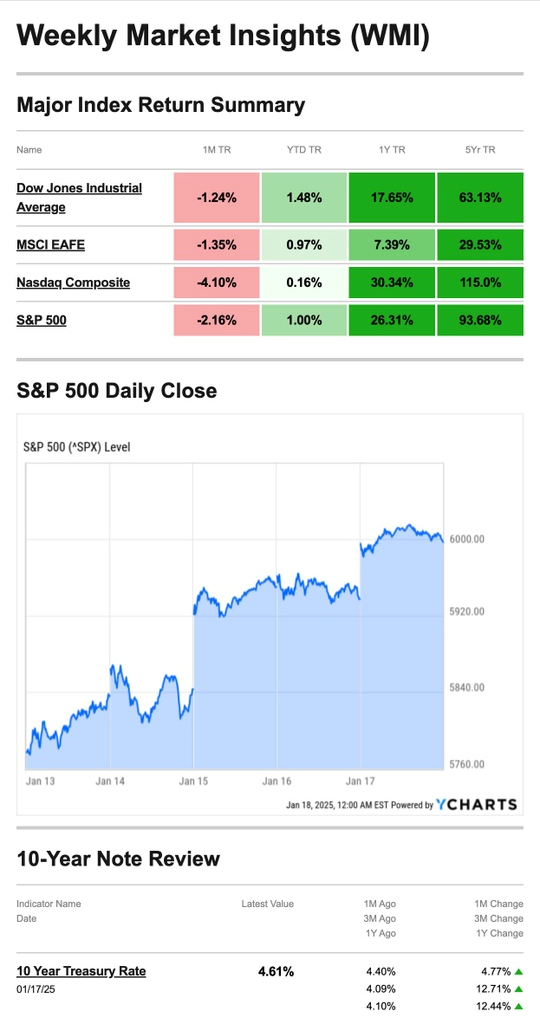

The Standard & Poor’s 500 Index rose 2.91 percent, while the Nasdaq Composite Index advanced 2.45 percent. The Dow Jones Industrial Average led, picking up 3.69 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, added 2.00 percent.1,2

Goldilocks is Back

The “Goldilocks” narrative—an economy that’s neither too hot nor too cold—made a comeback last week.

Tuesday’s Producer Price Index report showed that wholesale prices rose less than expected in December—one piece of evidence suggesting a cooling economy.3

Stocks jumped out of the gate Wednesday after the December Consumer Price Index (CPI) report showed core inflation (minus volatile energy and food prices) rose less than expected. Investors also cheered Q4 reports from a handful of money center banks and positive news out of the Middle East.4

Stocks took a breather Thursday before pushing higher again on Friday.5

The S&P and Dow Industrials had their best week since early November, and the Nasdaq saw its best weekly performance since early December. The yield on the 10-year Treasury note fell roughly 20 basis points over the week.6,7

Source: YCharts.com, January 18, 2025. Weekly performance is measured from Monday, January 13, to Friday, January 17. TR = total return for the index, which includes any dividends as well as any other cash distributions during the period. Treasury note yield is expressed in basis points.

Slowing Inflation

Investors welcomed the inflation reports, believing wholesale and consumer prices might trend lower in 2025.

First, producer prices came in at 0.2 percent, which was less than the 0.4 percent increase anticipated. Then consumer prices came in at 2.9 percent, slightly elevated, but the real story was core inflation. When you subtract out food and gas prices, CPI saw its smallest monthly increase since July.8

Beware of Phishing Scams

A phishing scam occurs when someone pretends to be a trusted source, such as a bank, tax preparer, or credit card company, to access your personal information.

If you believe you may be part of a phishing scam, here are some recommendations from the IRS:

- Never open an email from a sender that you don’t recognize.

- Never disclose personal information to anyone online, including your passwords, bank account numbers, credit card numbers, or Social Security number. The IRS will never ask for this information via email.

- When possible, use two-factor authentication to protect your accounts. Two-factor authentication requires a secondary form of identification (such as a phone number) to access your account.

*This information is not intended to be a substitute for specific, individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS10

Footnotes and Sources

1. The Wall Street Journal, January 17, 2025

2. Investing.com, January 17, 2025

3. CNBC.com, January 14, 2025

4. The Wall Street Journal, January 15, 2025

5. CNBC.com, January 17, 2025

6. MarketWatch.com, January 17, 2025

7. CNBC.com, January 17, 2025

8. The Wall Street Journal, January 15, 2025

9. IRS.gov, July 29, 2024

Stock market calendar this week:

| Time (ET) | Report |

| MONDAY, JAN. 20 | |

| None scheduled, Martin Luther King Jr. holiday | |

| TUESDAY, JAN. 21 | |

| None scheduled | |

| WEDNESDAY, JAN. 22 | |

| 10:00 AM | U.S. leading economic indicators |

| THURSDAY, JAN. 23 | |

| 8:30 AM | Initial jobless claims |

| FRIDAY, JAN. 24 | |

| 10:00 AM | Existing home sales |

| 10:00 AM | Consumer sentiment (final) |

| 9:45 AM | S&P flash U.S. services PMI |

| 9:45 AM | S&P flash U.S. manufacturing PMI |

Most anticipated earnings for this week

Did you miss our last blog?

Forefront Market Notes: January 13th

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.