A Season of Fatigue Without the Panic

Every year around the holidays, people tell me they are exhausted. This year feels even heavier. Families are dealing with stubborn prices, mixed economic signals, and coming out of the longest government shutdown on record. You can sense it in everyday conversations. You can see it in the data. None of this indicates a crisis is waiting around the corner. It simply means the country is running low on energy just as the shopping season begins.

Retail sales increased only 0.2 percent in September. Confidence dropped to a seven-month low. Anxiety about the job market is growing. These figures reflect what many households have felt all year. Not fear. Just fatigue.

Even so, the full story is more complex than a simple ‘slowdown’ headline. Spending is softening but not collapsing. People are cautious yet still buying what they trust. The real world often looks different from the tone of financial headlines, and right now, that difference is important.

Consumers Pull Back but Not All at Once

The data clearly shows a slowdown. Discretionary categories like electronics, clothing, and sporting goods weakened as the third quarter wrapped up. Control group sales declined for the first time in five months, indicating a loss of momentum after a strong performance earlier in the year.

However, retailers with strong brand loyalty are holding up well. Kohl’s, Best Buy, Abercrombie, and Dick’s all raised their forecasts. Best Buy mentioned that back-to-school and October spending exceeded expectations. They anticipate stronger results for Black Friday and Cyber Monday. More than half of Americans say they will spend at least as much as they did last year. This is due to higher prices but also a desire to stay consistent during the holidays.

People might feel worse, but they haven’t stopped living their lives. That gap between how people feel and how they act is one of the key themes of this economy.

Shutdown Distortions and the Fed’s Blind Spot

The shutdown disrupted the timing of several key reports. Retail sales for September were released late. Consumer confidence figures were gathered right after the shutdown ended, which exaggerated the anxiety. This may lead to a small rebound in December as the emotional impact diminishes.

Wholesale inflation was moderate once you exclude food and energy. That boosted expectations that the Federal Reserve might consider cutting rates at the December meeting. The issue is that policymakers lack recent labor or inflation data because those reports were delayed. They are heading into an important meeting without a complete picture.

This is why the market feels unstable and inconsistent. The data is incomplete, and the signals don’t align clearly.

Where Households Are Feeling the Pressure

Wells Fargo observed that higher-income households continue to support overall spending, while lower and middle-income families struggle with slower wage growth and rising essential costs. This aligns with the conversations many advisers have every day. The pressure is felt in the middle, not at the top.

Food and energy remain the main sticking points. Core producer prices increased 2.6 percent over the past year, the slowest pace since mid-2024, yet food prices edged higher. Companies are cautious about price hikes amid tariff pressure and weakening demand. The overall picture is mixed, giving the Fed some room to cut rates but not a strong reason to act quickly.

A Job Market That Sends Mixed Signals

Private payrolls decreased by an average of 13,500 each week over the four-week period ending November 8. Meanwhile, the government’s September report indicated strong job growth, mostly driven by just two sectors. This creates a kind of confusion that shakes confidence. People hear stories of layoffs, while others see companies hiring vigorously in certain areas. The conflicting signals and tension are reflected in surveys and spending patterns.

People say they feel uncertain. Still, they keep spending on trusted brands. Incomes seem to be slowing down. However, households with savings or stable jobs continue to support the economy. This explains why analysts disagree on what will happen next. The data is confusing, not disastrous.

What It Means for Your Plan

Moments like this reward calm behavior. Not excitement. Not panic. A slowdown in spending doesn’t necessarily mean a recession. A tired consumer doesn’t always drag the economy into worse trouble. Markets often confuse discomfort with danger, and that confusion can lead people to emotional decisions that hurt them in the long run.

Your financial plan is designed to withstand this environment. It aims to keep you stable when the economy becomes volatile. It provides you with space to breathe when headlines feel overwhelming. You don’t need to predict the next market move. A perfect forecast isn’t necessary. All you need is consistency and patience.

Consumers are tired but still moving forward. Prices are cooling in some areas and rising in others. Jobs are strong in certain sectors and weak in others. The message is mixed, not dire. The most important thing you can do is stick to the plan that protects your future when the world feels uncertain.

Sources

- Census Bureau

https://www.census.gov - Bureau of Labor Statistics

https://www.bls.gov - The Conference Board

https://www.conference-board.org - Bloomberg

https://www.bloomberg.com - Pantheon Macroeconomics

https://www.pantheonmacro.com - BMO Capital Markets

https://capitalmarkets.bmo.com - LPL Financial

https://www.lpl.com - Wells Fargo Economics

https://www.wellsfargo.com/economics - High Frequency Economics

https://www.hifreqecon.com - ADP Research Institute

https://adpri.org - Stanford Digital Economy Lab

https://digitaleconomy.stanford.edu

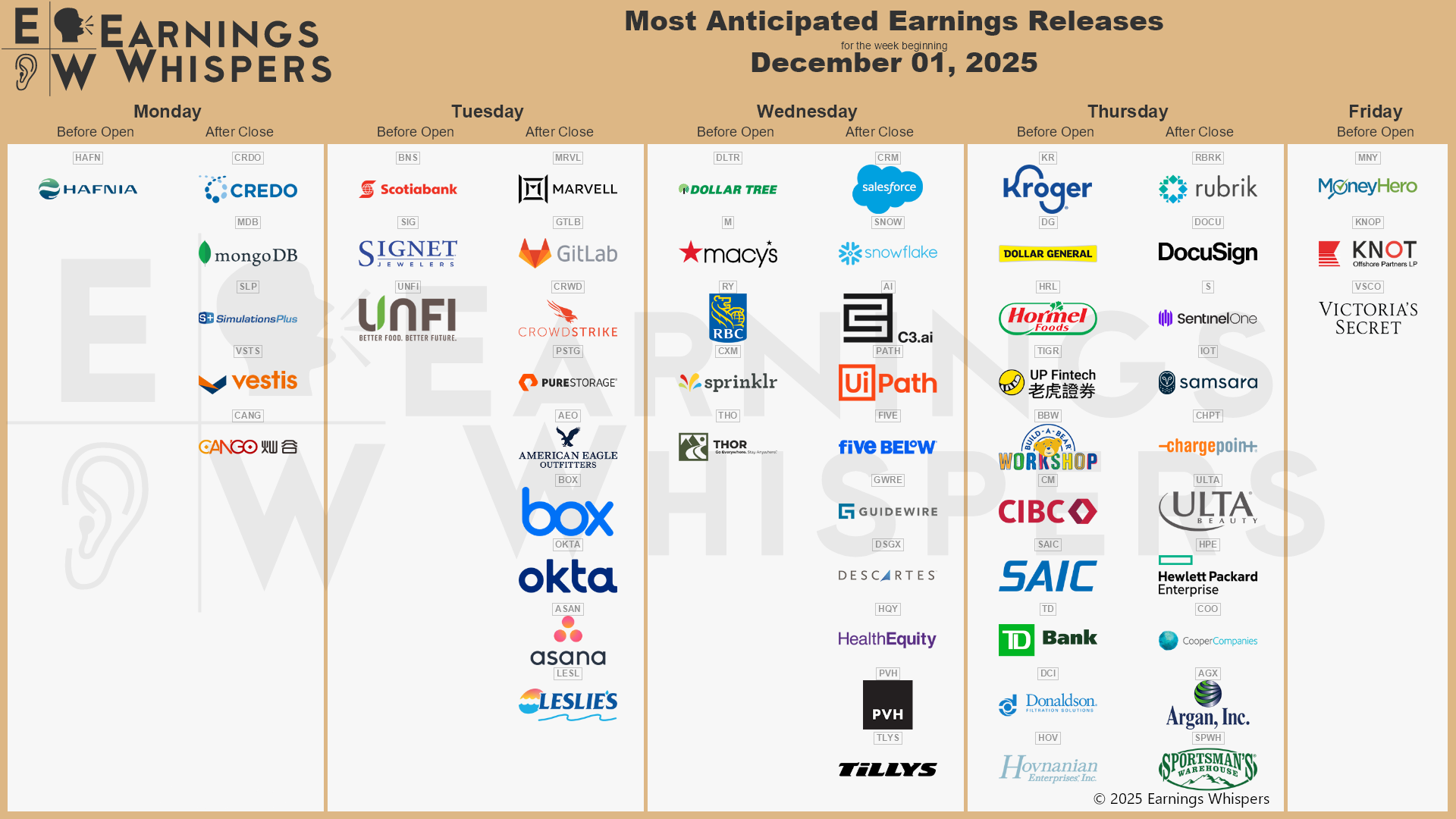

Stock Market Calendar This Week:

| Time (ET) | Report |

| MONDAY, DEC. 1 | |

| 9:45 AM | S&P final U.S. manufacturing PMI |

| 10:00 AM | ISM manufacturing |

| 8:00 PM | Fed Chair Jerome Powell speaks |

| TUESDAY, DEC. 2 | |

| 10:00 AM | Fed Vice Chair for Supervision Michelle Bowman testifies |

| TBA | Auto sales |

| WEDNESDAY, DEC. 3 | |

| 8:15 AM | ADP employment |

| 8:30 AM | Import price index (delayed report) |

| 8:30 AM | Import price index minus fuel |

| 9:15 AM | Industrial production (delayed report) |

| 9:45 AM | S&P final U.S. services PMI |

| 10:00 AM | ISM services |

| THURSDAY, DEC. 4 | |

| 8:30 AM | Initial jobless claims |

| 12:00 PM | Fed Vice Chair for Supervision Michelle Bowman speaks |

| FRIDAY, DEC. 5 | |

| 8:30 AM | Personal income (delayed report) |

| 8:30 AM | Personal spending (delayed report) |

| 8:30 AM | PCE index (delayed report) |

| 8:30 AM | PCE (year-over-year) |

| 8:30 AM | Core PCE index (delayed report) |

| 8:30 AM | Core PCE (year-over-year) |

| 10:00 AM | Consumer sentiment (prelim) |

| 3:00 PM | Consumer credit |

Did you miss our last blog?

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.