By Dr. JoAnne Feeney

Portfolio Manager

The recent escalation in trade tensions, following Trump’s announcement that he intends to impose a 10% tariff on the remaining $300 billion of Chinese imports, has sent markets into another downward spiral and pushed volatility (as measured by the VIX) back above 20. A 10% tax on the rest of imports from China would land on consumer goods, and the breadth of that impact has investors worried that the U.S. economic expansion could be derailed. But let’s take a closer look.

Last week I wrote about the disparity in earnings results of companies with greater than 50% exposure (in sales) to markets outside the U.S. Those results illustrate some of the adverse effects of the ongoing U.S.-China trade war. For many companies, these effects are not trivial. The overall impact on the U.S. economy, by contrast, has been far more muted, leaving some to believe that the costs of U.S. tariffs—and the retaliation by China—have been minimal.

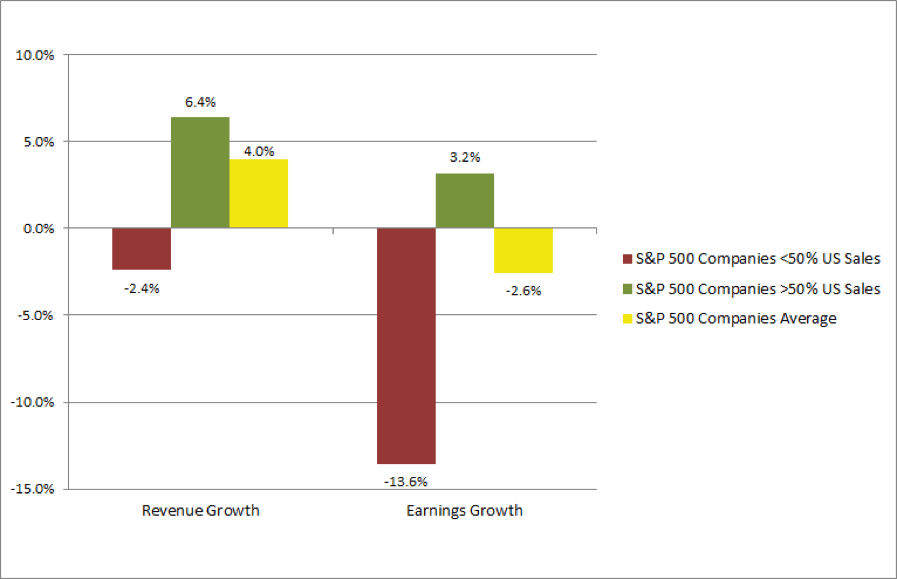

Take another look at the following chart, and notice that average S&P 500 earnings last quarter were down only slightly even as companies with more than 50% of sales outside the U.S. saw a double-digit year-over-year decline in 2Q profits:

2Q Results: Companies with More Global Exposure Suffering

Source: FactSet

Thus far, the largest impact of the trade war on U.S. exports has been in reduced sales of agricultural products (soybeans), semiconductors, autos, and aircraft. The higher costs of Chinese imports has mostly been concentrated in industrial products, which indirectly raise the costs of final goods to consumers here in the U.S. But the new tariffs, if Trump carries through with this threat, would create a 10% tax on imports of consumer goods. Note that this makes those tariffs more easily understood by consumers—and voters—and they will immediately recognize that it is they who are paying the tariffs, not the Chinese. A consumption tax is highly regressive, meaning it impacts those most at the lower end of the income distribution who need to spend their entire paycheck on household necessities. Much of Trump’s base falls into this category, which suggests this threat may prove too politically costly to carry out.

It is not only the trade war that is to blame for investors’ response to the latest presidential tweets. Investors are already concerned that companies are facing headwinds from the slowdown in Europe and from the more secular slowdown in China’s growth rate. Recall that China has been a developing economy for many decades. Its growth spurt was helped along by the rest of the world’s willingness to allow China to have access to advanced technologies from the U.S., Europe and elsewhere. But that free access is now being ended, and the U.S. is leading the charge. China’s growth is slowing—and that is the natural path for a developing country, with or without a trade war. Despite these headwinds, the U.S. economy as a whole continues to grow at a modest pace, even as the companies with greater international sales see a severe decline in demand because of the European and Chinese slowdowns and the retaliatory actions from China.

Note also from the chart above those companies with less than 50% of sales outside the U.S. are continuing to benefit from the ongoing U.S. economic expansion—particularly strength in the U.S. consumer. It is worth reiterating the strengths in the U.S. economy—strengths which have very little to do with trade. Consumer spending continues to grow and was most recently reported up 4.2% in May versus last year. And while the housing market is mixed, new home sales are arguably the more important signal since new construction adds considerably to domestic company sales While existing home sales declined 2.2% year-over-year in June, new home sales climbed 7%. Mortgage rates remain low, household income is rising, and the leading edge of millennials is entering the housing market, so we expect new home sales to continue to grow, especially for entry-level homes. Existing home sales are likely to face ongoing challenges, however, as homeowners remain reluctant to cut prices enough to absorb the new reality of limited interest and local real estate tax deductions. In addition, ongoing technology and demographic trends offer tailwinds to companies in several different sectors, including Health Care, where 100% of companies beat earnings estimates. The tariffs will hurt consumer spending, but not very much since consumers can shift spending away from the pricier Chinese goods to products from other low-cost countries, such as Vietnam. We are already seeing multinationals shift production out of China to avoid the tariffs. This will continue.

So while the latest tweet has investors concerned, the U.S. economy is likely to continue to provide a solid growth environment for U.S.-centric companies, as well as multinationals. There are some companies and sectors more exposed to China, but even those are reducing vulnerability by shifting supply chains. And as we noted last week, companies which rely more heavily on international sales are exposed to some of the strongest secular drivers of this era. These include U.S. technology companies, pharmaceuticals, medical device companies, defense companies and many others. By avoiding companies with a majority of sales outside the U.S., investors will miss out on owning companies with some of the strongest growth prospects available. During this time of volatility, opportunities also emerge—some of the multiples on stocks of companies exposed to the strongest of those growth drivers have sunk so low that PEG ratios (P/E to Growth ratio) have fallen below one. This means investors get to buy a stock with strong earnings growth very cheaply indeed. When market volatility spikes, the wise investor will seize such opportunities.

And as I noted last week, no one really knows when a trade deal will arrive, irrespective of ongoing public announcements. Trying to time politics is akin to trying to time the market – it’s usually fruitless and often counterproductive.

ACM is a registered investment advisory firm with the United States Securities and Exchange Commission (SEC). Registration does not imply a certain level of skill or training. All written content on this site is for information purposes only. Opinions expressed herein are solely those of ACM, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation. All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment plan or strategy will be successful. ©ACM Wealth