The Plan Is the Product, Not the Portfolio

I hate comparing financial planning to losing weight, even though I lost 100 LBS using the principles I use when creating financial plans. I tracked all the food that I ate and created a program designed to allow me to eat healthy 95% of the time and indulge at events like weddings and summer BBQs. This sounds a lot like creating a budget and monitoring spending so you can splurge on fun things like family vacations.

I wouldn’t say I like the analogy because the idea of creating and sticking to a budget for most people is akin to having their eyes gouged out with a spoon. The budgeting exercise has been found to bring up feelings of guilt and sadness, but it is just a singular data point that we use.

The 4-step process I use for my clients at Forefront Wealth Planning doesn’t have a fancy name, but that is just because I haven’t thought of something witty yet. We are open to suggestions!

Step one is to get organized. Anxiety is borne from chaos, and having accounts scattered all over has a meaningful psychological impact on us. The families I serve who have come to me for financial planning often don’t know how much they have or what it’s invested in.

Getting organized doesn’t mean you need to know down to the penny what you spent on haircuts this year, but it does mean combining old accounts where appropriate and giving each dollar a purpose and timeframe.

Christina, my wife, and I know that the money in our high-yield savings account, separate from our emergency fund, is to redo our driveway. When we add to that account, it is with the sole purpose of accomplishing our goal.

We won’t sacrifice the goals that are more important to us, like our children’s education or our retirement, to fund shorter-term wants, like a smooth driveway.

Aligning your money with your goals is vital for success, but aligning yourself with your spouse to work towards mutual goals is required if you want any chance at achieving your dreams.

This is a tricky step because most people think allocating means picking what investments go into your portfolio.

In my plans, it means allocating your resources, both time and money. How much money from each paycheck can we allocate toward your emergency fund? If your emergency fund is already covered, how much can we allocate toward 401K and retirement accounts, or towards your new car fund, etc….

This also means discussing how you allocate your time. One of the best pieces of advice my mentor ever gave me was to hire a cleaning service for my home. The argument was that with two young children and two working parents, whatever free time we have should be spent together, not stressing over who will clean which bathroom.

For years, I thought it was a frivolous expense, but as soon as I realized how much time it freed up for Christina and me, it quickly became one of the best allocations of resources to free up time I have ever made.

How can we allocate your resources to free up your time and make you happier?

Again, most people will think growth has to do with your investments going up, but our plans focus on growing two key metrics.

Savings rate growth is the most important metric that we follow. We want to consistently work towards growing your savings rate above all else. As your savings rate increases, so will your net worth. It is hard to accumulate credit card or consumer debt when you consistently raise your savings rate. The more you save and put away, the higher your net worth.

The one metric we look to avoid growing is your average tax rate. Planning is about keeping as much money in your pocket as possible, so working closely with your CPA to ensure we are being as tax efficient as possible.

So, What

It is never too late to create a financial plan, which doesn’t mean writing down all your expenses or any of the painful things usually associated with planning.

Finding someone you trust with a process that works is all you need. Remember, the plan is the product, not the portfolio.

Stock market calendar this week:

| TIME (ET) | REPORT |

| MONDAY, SEPT. 11 | |

| None scheduled | |

| TUESDAY, SEPT. 12 | |

| None scheduled | |

| WEDNESDAY, SEPT. 13 | |

| 8:30 AM | Consumer price index |

| 8:30 AM | Core CPI |

| 8:30 AM | CPI (year-over-year) |

| 8:30 AM | Core CPI (year-over-year) |

| THURSDAY, SEPT. 14 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | Producer price index |

| 8:30 AM | Core PPI |

| 8:30 AM | PPI (year-over-year) |

| 8:30 AM | Core PPI (year-over-year) |

| 8:30 AM | U.S. retail sales |

| 8:30 AM | Retail sales minus autos |

| 10:00 AM | Business inventories |

| FRIDAY, SEPT. 15 | |

| 8:30 AM | U.S. import prices |

| 8:30 AM | Empire State manufacturing survey |

| 9:15 AM | Industrial production |

| 9:15 AM | Capacity utilization |

| 10:00 AM | Consumer sentiment (prelim) |

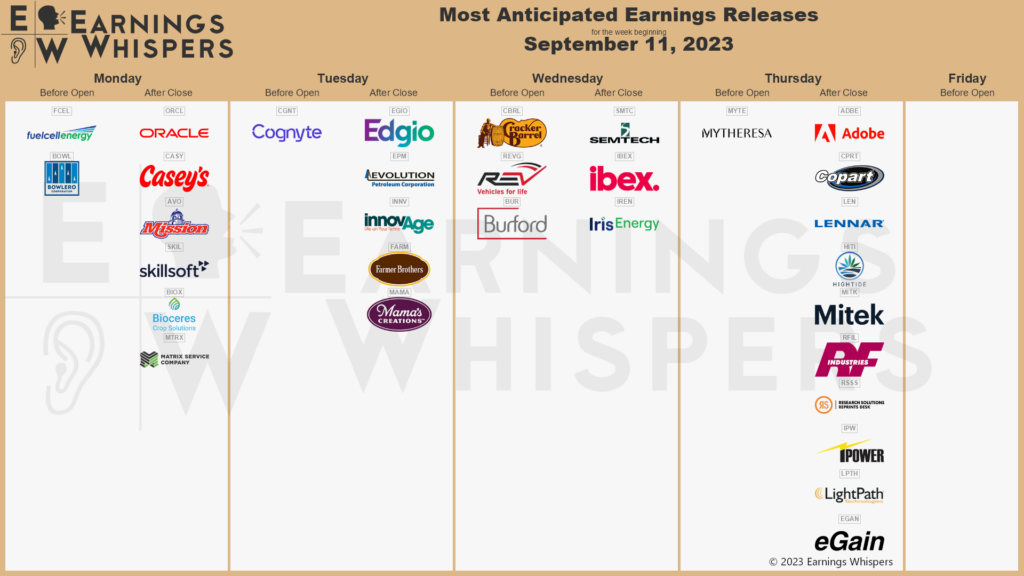

Most anticipated earnings for this week:

Did you miss our blog last week?

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.