Monkey Mind

Youth football season has started, so my son, AJ, has been at practice each night for the past two weeks. Yesterday was the football jamboree, where all our league teams came together and played twenty-minute scrimmages against each other.

AJ’s position has changed this year, and he is working hard to be the starting center for his team. For those of you who haven’t met AJ or had me show them the countless pictures I have on my phone, he is ninety pounds, soaking wet. To succeed on the line, he will need to use his brain more than his brawn.

While I was driving him to his game, we ran through his playbook to go over what direction the ball was going in, what hole the back would run through, and specifically, what AJ’s job was on each play. He has his playbook down, but during the drive, he expressed concern about things he didn’t control.

What if the person across from him is a 6th grader and much bigger than him? What if the other team’s defense blitzed through the B gap? What if it rains?

For those of you with kids or remember when your kids were little, you know this was only the tip of the iceberg for the questions he started rattling off to me. His monkey mind was causing anxiety and near paralysis with everything going through his head. We stopped talking about the playbook and started peeling back the layers of his monkey mind to understand what he can and cannot control.

Mind on My Money and Money on My Mind

Monkey mind is a Buddhist concept that relates to a state of restlessness, capriciousness, and lack of control in one’s thoughts.

Nothing causes monkey mind more than money and personal finance. Very few areas of life can your brain tell you that you have irrevocably changed the course of your and your family’s life because of a poor decision. How you behave is far more critical than what you know about money.

Personal finance is often taught as a math-based science; you’re given a set of data, input it into a formula, and it spits out what you should do. Never is it taught what those decisions do to you psychologically and how most people can’t do what they are supposed to because of monkey mind when it comes to money.

Reasonable not Rational

You are a living, breathing human being, NOT a spreadsheet. Making coldly rational decisions is something only some of us can do consistently. Instead of focusing on being coldly rational, try to be reasonable. Reasonable is much more realistic and will give you a better chance of sticking with your plan than trying to eliminate your emotions.

If we were all coldly rational, Disney World would not exist. No one, and I mean no one, would pay 64 dollars for waffles shaped like Mickey Mouse that are delivered to your table by Goofy and Pluto. Saving money for a while so that you can bring your children to a place that fills their souls with magic and their faces with delight is an entirely reasonable thing to do and brings so much more joy to your life than being coldly rational.

Break the Monkey Mind

I meet with prospective and new clients every week, and before I ever start discussing financial planning, or the process I use to create those plans, we discuss what is reasonable vs. what is rational. We peel back the layers of their monkey mind to find how to break that anxiety and lack of control in their thoughts. No plan will work unless we get ourselves in the right frame of mind, and good advisors an good parents should always start there.

Stock market calendar this week:

| TIME (ET) | REPORT |

| MONDAY, AUG.21 | |

| None scheduled | |

| TUESDAY, AUG.22 | |

| 10:00 AM | Existing home sales |

| WEDNESDAY, AUG.23 | |

| 9:45 AM | S&P flash U.S. services PMI |

| 9:45 AM | S&P flash U.S. manufacturing PMI |

| 10:00 AM | New home sales |

| THURSDAY, AUG.24 | |

| 10:00 AM | Fed officials interviews from Jackson Hole summit |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | Durable-goods orders |

| 8:30 AM | Durable-goods minus transportation |

| FRIDAY, AUG.25 | |

| 10:05 AM | Powell gives opening speech at Jackson Hole summit |

| 10:00 AM | U Mich consumer sentiment, final |

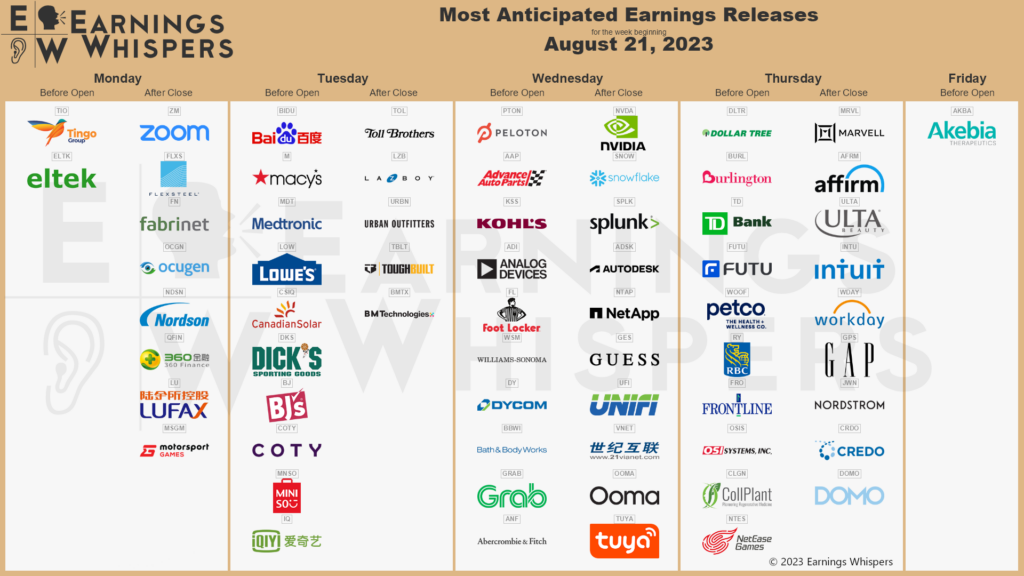

Most anticipated earnings for this week:

Did you miss our blog last week?

Income, Savings, or Returns. Which Matters Most?

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.