March 6, 2023

Forefront’s Monday Market Update

What the Bond Market is Saying

It shouldn’t surprise anyone that making money seems easy when the markets are doing well. But unfortunately, this past week, I was reminded how quickly that sentiment can change.

A family I served for several years decided to manage their own financial plan and asset allocation in May 2020. I have lived through enough bull markets to know that this will happen occasionally, and when gains in the market seem easy to take advantage of, some folks will go out on their own.

This family attended an event I spoke at last week, where I discussed what the bond market told us. They approached me after the event to set up a meeting for the next day for them to reengage my services and have me take over the financial planning and asset management for them.

When we sat down to go over everything, I asked them what helped them decide to reengage my services. They told me that my discussion on the bond market and what it might tell us made them realize that how my team and I evaluate markets and investments goes far beyond anything they did.

Shoveling Snow with a Rake

Trying to invest without understanding the bond market is like shoveling snow with a rake. Counterproductive and exhausting.

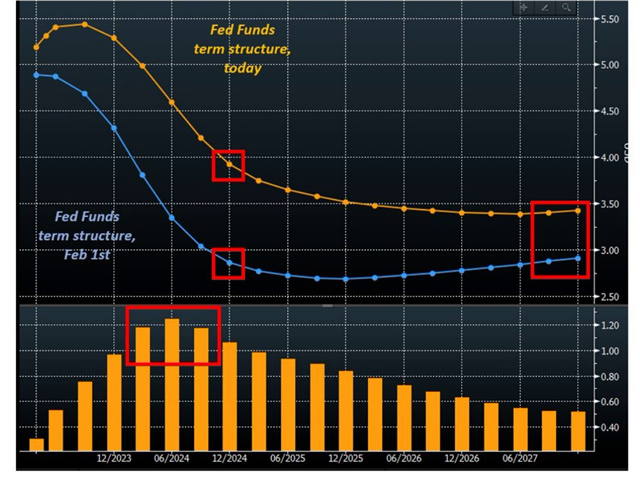

The SOFR futures market allows us to look at the market-implied Fed Funds rate at different time frames in the future. For example, see the chart below; the orange line shows investors’ expectations for the Fed Funds rate today. The blue line was investor expectations just a few short weeks ago, on February 1st, 2023.

There are a couple of important things to note here; at the moment, investors believe that by December of next year, 2024, the Fed Funds rate will still be over 4%. Just over a month ago, investors had expected the Fed to go through a series of rapid cuts, down to 2.75%, to create the perfect soft landing.

Why Does This Matter?

Monetary policy works through two main avenues. The first is shock, which we all have now felt, given how 2022 went. A rapid rise in interest rates caused a rapid repricing of valuations. The second way tighter monetary policy works is through time. The longer we keep rates higher, the more we force companies and households to reprice their mid-term expectations for the cost of borrowing.

Companies that would borrow to expand their business or families that would borrow to buy a home must reprice their expectations. For example, if you were looking at a home for $800K when interest rates were 3%, you would need to reprice the cost of the home you are looking for to fit within your means.

What the bond markets are telling us is that we will have a tighter monetary policy for longer AND that equilibrium rates (the point where interest rates stop going up or down) are going to be higher than we had expected.

The questions your advisor needs to be asking themselves when investing your money are will central banks bring inflation down to 2% quickly, or will it take more time than we are being told? Secondly, and more importantly, can the US Economy sustain equilibrium interest rates north of 3% and still have GDP growth within America?

Stock market calendar this week:

| MONDAY, MARCH 6 | |

| 10.00 am | Factory orders |

| TUESDAY, MARCH 7 | |

| 10:00 AM | Fed Chairman Powell testifies to Senate |

| 10:00 AM | Wholesale inventories |

| 3:00 PM | Consumer credit |

| WEDNESDAY, MARCH 8 | |

| 8:15 AM | ADP employment |

| 8:30 AM | U.S. trade balance |

| 10:00 AM | Fed Chairman Powell testifies to House |

| 10:00 AM | Job openings (JOLTS) |

| 2:00 PM | Beige Book |

| THURSDAY, MARCH 9 | |

| 8:30 AM | Jobless claims |

| 10:00 AM | Fed Gov Waller speaks |

| FRIDAY, MARCH 10 | |

| 8:30 AM | Employment report |

| 8:30 AM | U.S. unemployment rate |

| 2:00 PM | Federal budget |

Most anticipated earnings for this week:

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.