As January goes, so goes the year

I love “rules” like this. Early in my career I used to pay close attention to them, like this one, “sell in May and go away”!

There is probably as much scientific proof behind either of those “rules” as there is trusting Punxsutawney Phil with predicting the weather. Which by the way he did a pretty terrible job of because he predicted 6 more weeks of Winter! I have no idea if he is correct or not, but I prefer to go with Staten Island Chuck who did not see his shadow indicating an early Spring.

Rules to live by

Instead of listening to Groundhogs as Meteorologists, or using random sayings as gospel we should look at something that many people are overlooking in this time of market euphoria.

The National Endowment for Financial Education finds that 96% of Americans will experience at least 4 income shocks in their careers.

- Divorce

- Kids

- Medical Emergency

- Job Change

- PANDEMIC

- Job Loss etc.

An income shock is defined as when your income falls by 10% or more. What this tells me is that emergency funds are a necessity, not a luxury.

How fast behaviors can change

I am not shy about telling you that the maximum value a financial planner/advisor provides to you is psychological. None of us can make the markets go up, but we can make sure you are there for when it happens instead of on the sideline because of panic.

I preach to my clients that you should always have between 9-12 months of annual expenses in cash. This was a tough sell already because of interest rates being close to 0%, throw in the ease of a Robinhood account and day trading and the emergency fund has become almost nonexistent.

Short-term thinking for survival

Humans are programmed to think short term. Evolutionary, thinking short term makes a ton of sense. It maximizes your likelihood of survival which is never a bad thing.

Finances, and money in general is all about training yourself to develop a long-term mindset. Is now the right time to say “it’s a marathon, not a sprint”? I know everyone is waiting for that unique and unheard of piece of advice!

Forget about running all together. Walking to your destination is fine, but do it while keeping real “rules” in mind and not trusting what “they” say, or a groundhog who predicts the weather.

So What?

So how does this impact all of you?

- Forget what “they” say. Whether in the disitribution or accumulation phase follow the rules that are tried and true!

- Groundhogs can’t predict the weather…..unless spring comes early and Staten Island Chuck has superpowers.

Stock market calendar this week:

Wednesday February 10th:

Fed President Jerome Powell Speaks on Labor Market @ 2:00PM

Thursday February 11th

Initial and continuing Jobless Claims @ 8:30AM

Most anticipated earnings for this week

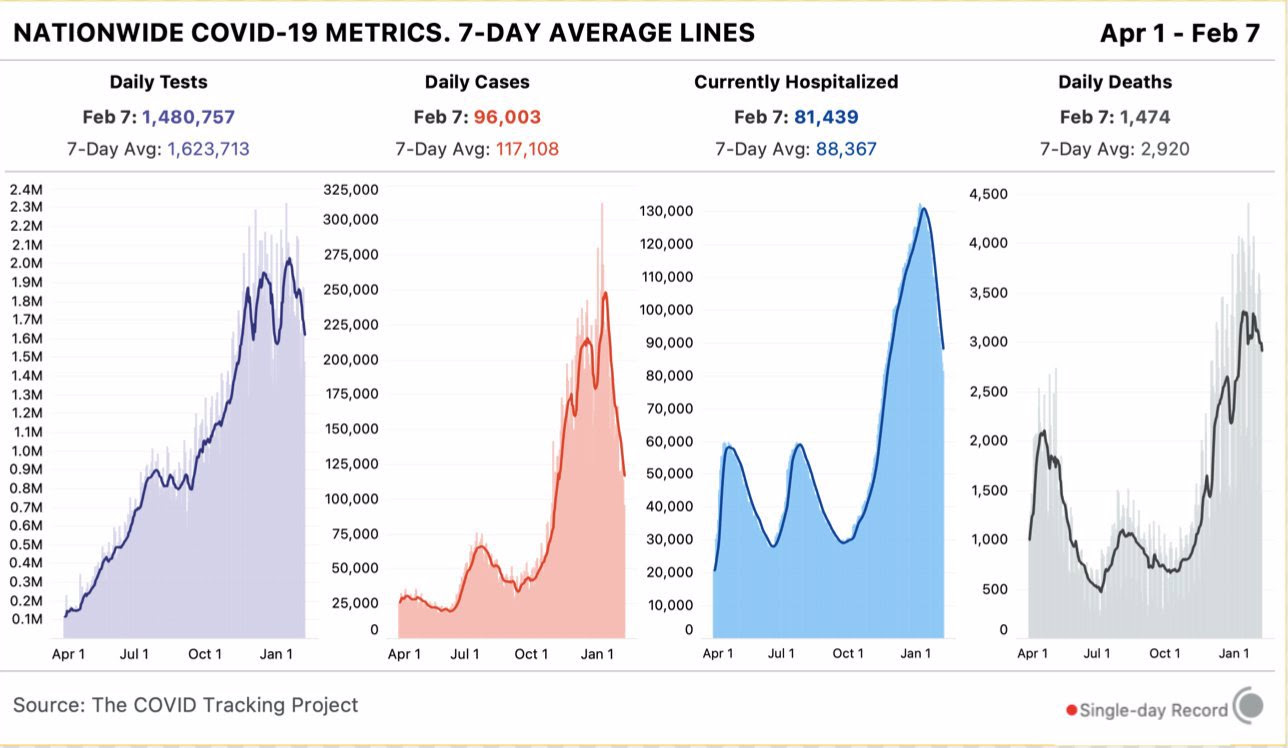

Latest Covid-19 Data