by Jeff Deiss

CFP, AEP, Wealth Advisor

With the equity market indices (Dow Jones Industrial Average, S&P 500 index) hitting all-time highs recently, most investors are feeling good financially.

We’ve been writing recently about the behavioral aspects of investing and how our emotions play a role. Why? As a reality check and a reminder that things may not always be as good as they are now. That’s life, and both our lives and the economy and the markets have their cycles.

There are certain things that we can control in life, like how much we save and spend. And there are things that we can’t, like the economic cycle and stock market volatility. For the latter, however, we can control how we respond to them.

We are wired to find the wrongs things tempting at the wrong times like buying at market highs when we are feeling good or when we feel like we are missing out and selling at market lows when we are overly pessimistic and fearful that we’ll lose all our money. In the long run, both are common investor mistakes and a recipe for underperformance.

So here are a few things that hopefully we can refer back to when our instincts kick in and have the potential to undermine our long-term investment success.

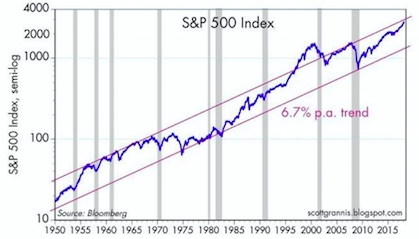

Remember that the stock market goes up over time, but that it doesn’t go up in a straight line.

In the short run, each new high in the stock market is not automatically replaced with another new high. The value on your account statements only tends to feel good when it’s the same or more than the last. Those months, or even years, where it’s worth less do not feel good and we need to remind ourselves that, like it or not, this is just a normal part of investing.

Not every market and economic cycle is the same length or reaches the same height or depth. But the average length of economic expansions has always exceeded the length of recessions and the markets ultimately return to new highs at some point.

Consider that over the course of the last century, the Dow moved from 68 on January 2, 1900, to 10,987 at the end of December 2000. This happened through multiple recessions, a depression, two world wars and other international conflicts, an energy crisis, the cold war and nuclear threats, disruptive inventions, and so much more.

Nineteen years later, and including the tech bubble, the financial crisis, ongoing conflicts in the middle east, government shutdowns and ongoing trade wars, etc. and the Dow is now at 27,000. Nineteen years is less than an average retirement today and so some historical context is a good reminder that consistent investment in a diversified portfolio of stocks works.

Investor behavior – not the markets – primarily determine an individual investor’s wealth prospects and financial outcomes. When the market sells off or experiences normal volatility, which it will, the best thing to do for most investors who have a long term plan is nothing. This is easier said than done. For investors, any drop in value feels scary and the time near a market bottom can be an emotional low. Even if you have stuck with your investment plan, you may feel defeated, even paralyzed at that point.

At this point, however, perseverance is key. As bad as it feels in the moment, remember that this too shall pass. On the way down, stick to your plan – invest and rebalance—and try not to succumb to the temptation to go to cash, which effectively means locking in your losses.

At the bottom of the cycle, stocks are on super sale. We’ve all heard stories of investors who have the perspective and fortitude to buy at the point of maximum fear and who have done very well when prices begin rising again. They know that, historically, powerful rebounds have followed some of the deepest market drops. At the inflection point, many investors are feeling regret and have already checked out. We don’t even want to look at our statements and perhaps have not done so in a long time. And as the market eventually rebounds, many remain skeptical and will sit on the sidelines long enough to miss the early, often powerful, rebound.

After the bottom comes the beginning of the bull market. The economy is showing signs of a rebound, employment is ticking up, interest rates are low, and corporate profits are beginning to increase. So are stocks: The average increase in the S&P the year after the bottom of a market cycle is 47%. Participating in these rebounds is an important part of your long term investment success. And chances are that you won’t if you were scared away on the way down and sitting in cash.

When the market goes down, think like a contrarian. The stock market will rebound, often sharply. If you stay invested, you eventually will see that your statement balance is coming back. If your allocation to stocks has fallen below your long-term goals, now is the time to steer your all-too-human nerves and bring your portfolio back to your long-term target rather than to run for a safer place to hide.

Successful investors stay on track by making a plan and sticking to it (and maybe by turning off the TV too). What this really means is choosing an investment strategy and asset allocation that considers your goals for retirement and income, your time horizon, and your ability to take on risk at stages or your life and through different stages in the market and economic cycle.

To stick to your plan, it’s helpful to work with a financial advisor to keep you focused on your goals and plan and to rebalance your asset mix as needed, adding to losing investment classes, and lightening up on the winners. Over time, that discipline helps successful investors—despite emotions—avoid the buy high/sell low temptation, and build wealth.

The pain of loss is said to be 3x the joy of any gains. So, by all means, enjoy times like now while they are good. But keep some perspective and avoid becoming complacent and thinking that they will last forever. Your long-term investment success will more likely depend on how you respond and control your emotions when the economy looks perilous and markets are volatile.

ACM is a registered investment advisory firm with the United States Securities and Exchange Commission (SEC). Registration does not imply a certain level of skill or training. All written content on this site is for information purposes only. Opinions expressed herein are solely those of ACM, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation. All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment plan or strategy will be successful. ©ACM Wealth