by Jeff Deiss

CFP, AEP, Wealth Advisor

“Olympic athletes are at the peak of their careers, but even they need rest days to stay healthy. The markets and the economy are no different. Sometimes they need to reset from record-setting performance, too.“

Following the recent stock market volatility in May, we wrote about emotional investing and how we as human beings are wired to make irrational decisions. It was easy to forget these comments given how quickly the equity markets rebounded.

Volatility came back only a month or so later as a result of tariff “tweets”, China digging its heels in for a protracted trade war and central banks around the world lowering interest rates as insurance against slower global growth.

This can raise some obvious questions – Is it different this time? Or is it normal? Are we headed into a recession? Does this even matter to me?

Downturns are normal and typically short

When it comes to stock market volatility, history tells us what’s been going on recently is perfectly normal. And you should expect to continue to see more of it.

It wasn’t too long ago that the market dropped about 20% and hit it’s 12 month low back on Christmas Eve, 2018 only to recover quickly and move on to new highs. For a refresher on few things to remember during periods of stock market volatility, click here for our piece from December 2018.

The stock market falls on average about 14% from high to low at least once a year and smaller stock market pullbacks 2-10% happen much more frequently. The key is to understand that stock market volatility is normal and not to let it, or some fear mongerer on TV or the internet, derail you from your long term investment plan. Why is this important?

First, markets tend to settle up, making market timing nearly impossible.

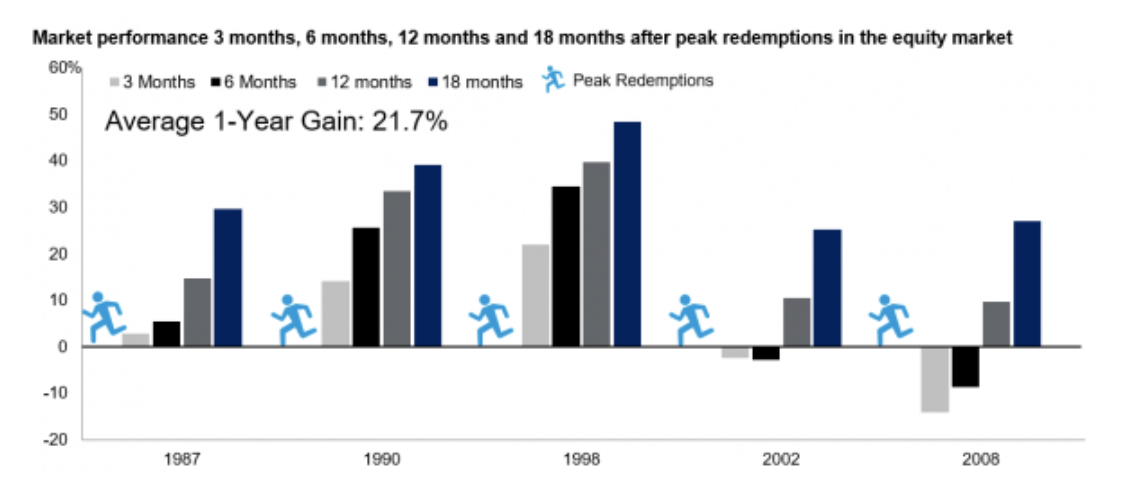

Source: FactSet Research Systems. Peak redemption months for equity flows are 10/31/87, 10/31/90, 8/31/98, 7/31/02, and 10/31/08. All returns are total return and calculated cumulatively on a monthly basis. Past performance does not guarantee future results

Given that a decision to get out of the market is an emotional decision, you’re fooling yourself if you think you’ll have the guts to jump right back in just when the market rebounds. Given how quickly the market typically rebounds, the odds are that you’ll miss it. Historically, the best days and weeks in the market have tended to group with the worst days and weeks in the market, when it’s the scariest and when we are less likely to make rational decisions. Missing these up days can significantly undermine your long term investment performance. The way to avoid this mistake is to stay invested, which was true during periods of market volatility so far this year, last December, in 2015 and 2016, and so on.

What about a recession?

Just like a bit of volatility tends to rattle us after a period of calm or rising markets, the next recession is likely to rattle us as well. This is because bear markets (corrections of 20%+) tend to accompany economic recessions. If history is any guide, however, then remember that recessions are normal and that they also come and go. The average length of a bear market is 299 days, or about 10 months, while the average length of a bull market is 989 days or 2.7 years. The bottom line is that longer-term, the market moves higher.

If you are planning to be retired for 25 or 30 years or longer (9,125 to 10,950 days), then you’ll likely experience a few recessions, and plenty of normal stock market volatility, along the way. In the midst of a recession and/or a bear market, try to stay calm and remember that this too shall pass.

Olympic athletes are at the peak of their careers, but even they need rest days to stay healthy. The markets and the economy are no different. Sometimes they need to reset from record-setting performance, too.

Even in the depths of the financial crisis of 2008, global commerce did not stop. The economy reset and markets made up what they had lost and ultimately moved on to new highs. In the context of a 25 or 30-year retirement, even this “reset” was relatively short.

For most investors, the best course of action was to stand firm and do nothing, assuming that you had a plan and your asset allocation in the right place, to begin with.

Get a plan you can stick with through market ups and downs

History shows that, in aggregate, many investors often buy into markets near peaks and sell near bottoms (the opposite of what we should do). Instead of trying to jump in and out of the market, reality-check your investment mix to be sure it is still right for your own goals and risk tolerance.

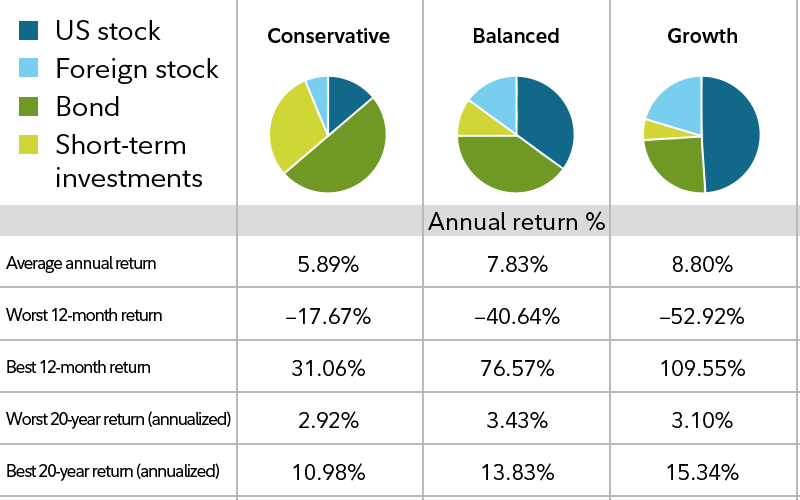

Past performance is no guarantee of future results. Data source: Ibbotson Associates, 2019 (1929-2018)

Your needs should drive how you invest your assets and your allocation should be set to allow you to remain invested during the ups and downs of the equity markets over time.

If, for example, your need is to draw 4% from your portfolio every year in retirement, then you don’t need to have all of your assets in stocks. Having half of your portfolio in stocks should still get you what you need. Allocating some portion of your portfolio to bonds and/or cash serves the purpose of smoothing out the changes in value to your overall portfolio, which should make it easier to keep your equity allocation invested. In the long run, staying invested is the key to investment success.

Work with your advisor to keep perspective and look for opportunitiesIt’s theoretically easy for many investors to pick their own investments. Buying a stock or an index fund online today is not much different than making a purchase on Amazon. But unlike Amazon, there’s no “return policy” in the stock market if you don’t like what you bought.

For individual investors, the challenge is sticking with what you bought while navigating through the fog – changes in the markets and the economy – at the same time. The path forward in the near term is often unclear and, as a result, many investors who attempt to go it alone have difficulty sorting out which headlines actually matter or how to confidently evaluate trade-offs and therefore they eventually make mistakes.

Working with an advisor can help you put a plan in place and a comfortable allocation to begin with and then help you to keep the above in perspective to keep you on track. Your advisor can also help you look for the positive aspects of a down market. During market downturns, you may be able to harvest losses to reduce future tax bills, use lower values to convert IRA assets to a Roth IRA at a lower cost, or rebalance your overall mix of stocks, bonds, and cash if your goals or needs have changed.

ACM is a registered investment advisory firm with the United States Securities and Exchange Commission (SEC). Registration does not imply a certain level of skill or training. All written content on this site is for information purposes only. Opinions expressed herein are solely those of ACM, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation. All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment plan or strategy will be successful. ©ACM Wealth